Apr 10, 2024

DeFi Exchange Creator Uniswap Labs Says SEC Sent It Lawsuit Warning

, Bloomberg News

(Bloomberg) -- Uniswap Labs, the creator of the largest decentralized trading platform on Ethereum, said the US Securities and Exchange Commission has warned that it faces a potential enforcement action for operating as an unregistered exchange and broker dealer.

The SEC’s Enforcement Division served Uniswap with a Wells Notice, notifying the company that it plans to recommend a legal action against it, the firm said in a blog statement. A representative for the SEC declined to comment.

Chairman Gary Gensler has long said that decentralized crypto exchanges aren’t really decentralized and fall under its purview. The claims that Uniswap is an unregistered broker dealer and exchange are similar to cases the agency brought against centralized exchanges Coinbase Global Inc. and Binance last year, according to Marvin Ammori, chief legal officer for Uniswap.

“The base underlying subtext of the entire SEC action is that most tokens are securities,” Ammori said Wednesday during a conference call.

Decentralized exchanges have long argued that they are structurally different than centralized exchanges, and are simply pieces of software that people use for trading without intermediaries. Decentralized exchanges accounted for more than 27% of all crypto trading volume over the last 24 hours, while centralized exchanges accounted for the rest, according to data tracker DeFi Llama, which lists more than 400 DeFi exchanges. In addition to Uniswap, other large DeFi trading platforms include Jupiter, PancakeSwap and Orca.

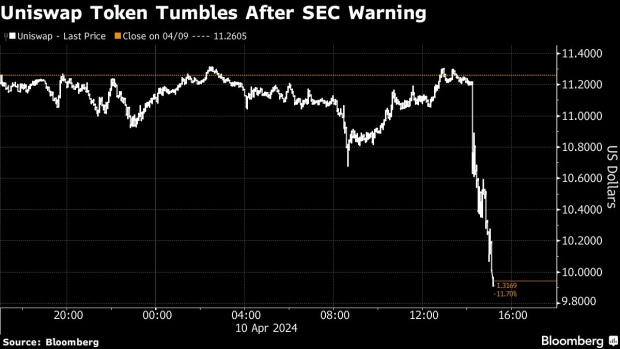

Uniswap’s UNI token fell around 11% to $10 on Wednesday. Prices of other native tokens of decentralized exchanges are down by similar amounts, according to data compiled by CoinGecko.

“The SEC is trying to kill innovation that we think is inevitable,” said Mary-Catherine Lader, Uniswap’s chief operating officer, said during the call. “We are looking forward to winning.”

--With assistance from Austin Weinstein.

(Updates with Uniswap comments, SEC allegations, starting in the first paragraph.)

©2024 Bloomberg L.P.