Apr 26, 2024

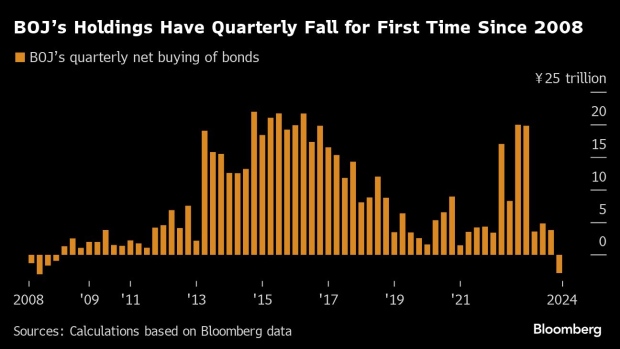

Drop in BOJ’s Bond Holdings Gives Market Taste of Quantitative Tightening

, Bloomberg News

(Bloomberg) -- Investors in Japanese government bonds have already had a taste of quantitative tightening by the nation’s central bank.

The BOJ’s net purchases fell to minus ¥2.79 trillion ($17.9 billion) in the first quarter as redemptions swelled, based on Bloomberg analysis of central bank data. While its holdings often drop in March, it’s the first time since 2008 that they’re down for the entire three-month period.

The market may do well to keep a close eye on these purchases going forward as traders parse a short monetary policy statement from the central bank on Friday. The BOJ said it would conduct bond purchases in accordance with the decisions made at the March meeting when it moved away from rock-bottom rates.

“The BOJ is unlikely to maintain its bond holdings but is just waiting for the right time to start to cut purchases, considering elevated inflation,” said Takeshi Minami, chief economist at Norinchukin Research Institute. Full-scale quantitative tightening may start as early as the July-September period, Minami said.

The monetary authority said bond buying would remain broadly in line with previous levels of about ¥6 trillion per month. The yen weakened to a fresh 34-year low against the dollar as the BOJ’s decision kept the huge gap in place between interest rates in Japan and other major economies.

Japan’s benchmark 10-year yield climbed as much as 4 basis points to 0.93%, the highest since November.

Governor Kazuo Ueda has repeatedly said that the BOJ would eventually reduce its bond buying at an unspecified point in the future. The central bank owned 54% of outstanding government bonds at the end of last year.

“The BOJ could buy less bonds under the radar in what is known as ‘stealth tapering,’” said Stephen Chiu and Chunyu Zhang, analysts at Bloomberg Intelligence, in a report Friday.

(Updates with 10-year yield moves in sixth paragraph.)

©2024 Bloomberg L.P.