Apr 17, 2024

Emerging Markets Selloff Pauses as US Dollar Consolidates Gains

, Bloomberg News

(Bloomberg) -- Developing-world currencies clocked in their first gains in a more than a week amid a rebound in risk assets as traders continue to adjust to expectations the Federal Reserve will hold interest rates higher for longer.

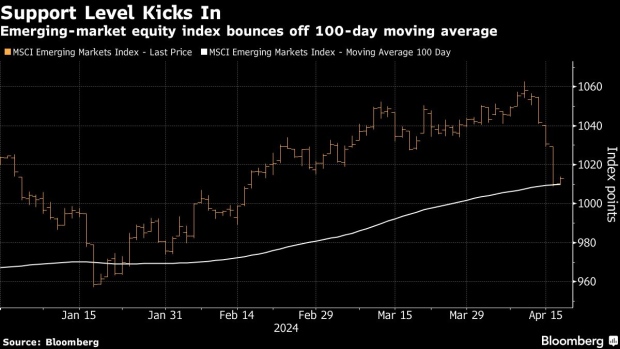

High-yielding currencies from Brazil, Poland and Mexico, which took a beating during the global risk selloff this week, were among the best performers Wednesday. Developing world equities bounced back from the year’s low.

Volatility dwindled around the world as money markets pushed backed bets on the start of the Fed’s easing cycle after strong US data and signals from policymakers it’d take longer to tame inflation. Investors are also shrugging off concerns over geopolitical tensions in the Middle East.

“The only thing that has changed is a reset for Fed rate cut expectations, so the positive drivers present at the start of the year are still there,” said Ian Simmons, a London-based fund manager at Fiera Capital. “Most large markets are enjoying cyclical and structural improvements with other exciting opportunities in the smaller markets.”

Treasury yields traded lower, in a narrow range near 2024 highs, and a gauge of the dollar came off a five-month high. Traders are awaiting speeches by Cleveland Fed President Loretta Mester and Fed Governor Michelle Bowman later Wednesday for new clues on the path of US monetary policy.

Read More: Powell’s US Rates Warning Means Headaches for Rest of the World

Emerging market debt investors also digested news from the spring meetings of the International Monetary Fund and World Bank in Washington, DC. Ecuador’s dollar bonds were among the best performers in emerging markets as investors expect a deal with the IMF will be announced in coming days. Notes from Sri Lanka rallied after Standard Chartered said the nation may reach a deal with bondholders in about a month, while debt from Pakistan and Argentina also outperformed amid talks in the US capital.

Egypt is trying to push back the date on which some of its domestic debt comes due, Finance Minister Mohamed Maait said in an interview.

Meantime, President Joe Biden’s administration reimposed oil sanctions on Venezuela, ending a six-month reprieve, after determining that Nicolas Maduro’s regime failed to honor an agreement to allow a fairer vote in elections scheduled for July.

--With assistance from Srinivasan Sivabalan.

©2024 Bloomberg L.P.