Apr 10, 2024

Equity Hedge Funds Fail to Beat Benchmarks Despite Tech Boost

, Bloomberg News

(Bloomberg) -- Stock-picking hedge funds gained more than any other major strategy in the first quarter thanks to some high-flying tech names — and it still wasn’t good enough to beat the markets.

As a group, stock-pickers gained 7.9% during the first three months of the year, according to PivotalPath’s Equity Sector Index. The S&P 500 and Nasdaq Composite Index returned 10.6% and 9.3%, respectively.

Several top equity hedge funds fell short of those marks, including Renaissance Technologies, Greenlight Capital and Pershing Square Capital Management — which all landed near the bottom of the group — as well as tech-focused firms such as Viking Global Investors, Coatue Management and Tiger Global Management.

As for some of the stock-pickers that managed to beat the benchmarks, those gains were largely driven by wagers on a small number of tech names in the Bloomberg Magnificent 7 Index, including Nvidia Corp., Amazon.com Inc. and Meta Platforms Inc. Investors paying high fees for hedge funds tend to favor returns that are uncoupled with markets or come from less popular trades.

“There’s not a whole lot of impressive equity performance this year,” PivotalPath’s Jon Caplis, who founded the hedge fund research firm, said in a interview. “Many of the returns are being driven by large tech stocks. Equities have risen across other sectors and across geographies, too, so it’s hard not to be making money.”

Read more: Oldest Hedge Fund Strategy Wins Cash After Two-Year Exodus

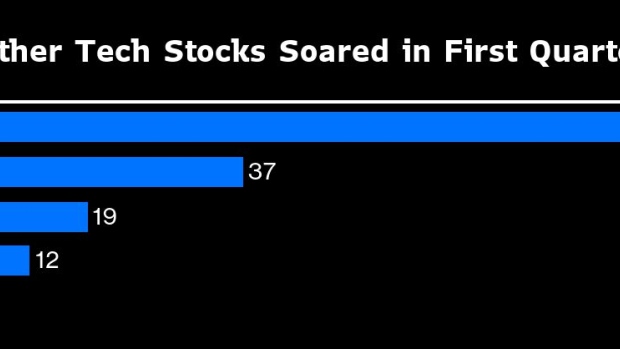

Many hedge funds that ratcheted back exposure to equities during the 2022 stock-market rout have been slow to restore it to typical levels, Caplis said. That’s particularly true of some tech-focused funds. While the average tech fund ramped up its exposure to the Nasdaq by 37% — the highest level since May 2022 — that’s still far from a peak at the start of that year, PivotalPath data show.

Light Street Capital Management, which oversees $760 million, returned more than 35% in the first quarter, and Whale Rock Capital Management gained more than 22%. Nvidia was Light Street’s largest holding as of Dec. 31, while Microsoft Corp., Meta, Amazon and Nvidia were top picks for Whale Rock, regulatory filings show.

Those four stocks accounted for more than 46% of the S&P 500’s gain in the first quarter.

Adam Singleton, chief investment officer of external alpha at Man Solutions, expressed concern that momentum in popular stocks can lead to crowded trades, heightening the risk of heavy losses if they quickly unravel.

“I have seldom felt so nervous,” Singleton wrote in a report earlier this month. Momentum trades have done well this year, “suggesting that winning trades keep on winning, which is either driven by or leads to crowding.”

It’s hard to effectively measure the risk of crowding and, as a result, it’s difficult for hedge fund investors to avoid, he wrote.

Yet demand is growing. Stock-picking funds attracted a net $1.5 billion in February — the first inflows in two years — according to data platform Nasdaq eVestment. And tech-focused funds may be back in favor.

Read More: Oldest Hedge Fund Strategy Wins Cash After Two-Year Exodus

“After a couple of choppy years, we’re seeing investors in hedge funds now starting to eye tech managers, by doing research and taking meetings again — hoping to capitalize on the recent momentum in equities,” said Jon Naga, head of business development at Williams Trading, which advises hedge funds on raising capital.

Equity hedge funds as a group beat most multistrategy funds, including the Schonfeld Strategic Partners fund, a top performer that gained 6.2%.

©2024 Bloomberg L.P.