Apr 16, 2024

European Stocks Sink in Worst Day Since July on Rates, War Fears

, Bloomberg News

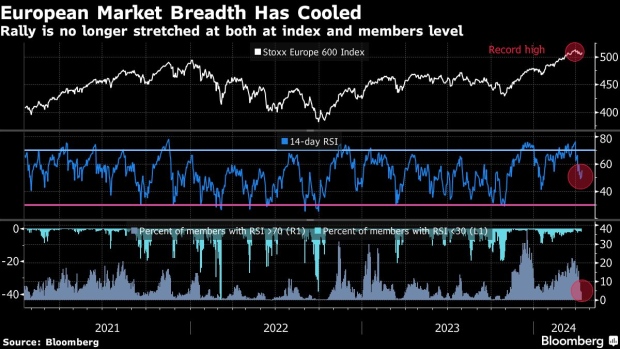

(Bloomberg) -- European stocks slumped by the most in more than nine months on concerns that the conflict in the Middle East may escalate, with investors also worrying about interest rates remaining higher for longer.

The Stoxx Europe 600 Index fell 1.5% by the close, its biggest one-day decline since July. Mining and banking stocks led losses. Among individual movers, UBS Group AG shares fell after the Swiss Finance Minister told local media that the bank faces an increase in regulatory capital requirements that could reach as much as $25 billion. Ericsson AB gained after earnings beat estimates.

Expectations for rate cuts have been pushed back after a slew of hot US economic data in recent weeks, weighing on European stocks in April after a strong first quarter. Federal Reserve Bank of San Francisco President Mary Daly reiterated there’s no urgency for easing, pointing to solid economic growth, a strong labor market and still-elevated inflation. Focus is on Federal Reserve Chair Jerome Powell’s speech later in the day.

“The economy is very strong and there is no urgency to cut rates,” said Rashmi Garg, senior portfolio manager at Al Dhabi Capital on Bloomberg Television, pointing to recent hot retail sales, inflation and job market prints in the US. “We need to see a few more data readings before we say with certainty when the Fed is going to cut, but I think definitely they get pushed out to later in the year.”

Sentiment has also been hit by an escalation in geopolitical tensions in the Middle East. Top Israeli military officials reasserted that their country has no choice but to respond to Iran’s weekend drone and missile attack, even as European and US officials kept up their calls for Israel to avoid a tit-for-tat escalation that could provoke a wider war.

In Europe, ECB Governing Council member Olli Rehn said geopolitics could derail plans to lower interest rates this summer as inflation slows.

Meanwhile, China announced faster-than-expected economic growth in the first quarter – along with some weaker figures for March that suggest there are still challenges on the horizon.

For more on equity markets:

- Geopolitics Complicates the Bull Case for Equities: Taking Stock

- M&A Watch Asia: HPSP’s Stake for Sale, Developer Times China

- As IPOs Flow, Amsterdam Shines With Neutral Appeal: ECM Watch

- US Stock Futures Unchanged; Live Nation Falls

- Can We Win the Inflation Race?: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika and Sagarika Jaisinghani.

©2024 Bloomberg L.P.