Apr 24, 2024

France Faces Credit Ratings Test as Debt Pile Continues to Mount

, Bloomberg News

(Bloomberg) -- A trio of upcoming rating assessments is set to test France’s bond markets by turning the spotlight on the country’s worsening debt picture.

A blow could arrive as soon as Friday, when Moody’s Ratings and Fitch Ratings review the nation’s credit score. The market sees a high chance the agencies will lower the outlook to negative. An actual downgrade could come next month, with S&P Global Ratings set to resolve a warning it has had in place for 18 months.

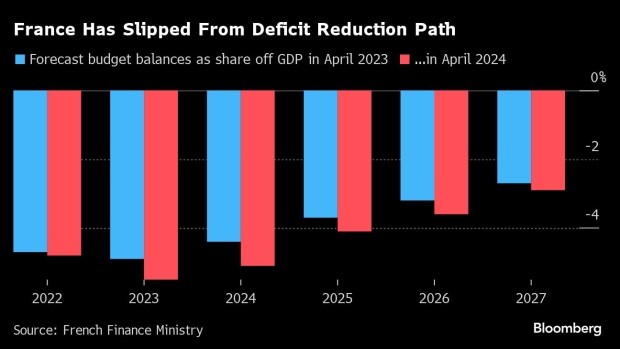

Concerns have been mounting over France’s finances ever since the government last week forecasted a bigger fiscal gap in the coming years. While the nation has announced emergency spending cuts, it has already acknowledged it won’t be able to meet targets as quickly as pledged — the economy remains weak and tax receipts are falling short.

“I definitely see chances of a negative outlook this Friday, if not a downgrade” from Moody’s, said Adam Kurpiel, head of rates strategy at Societe Generale SA.

For markets, a move this week would be a warning shot, but not completely unexpected. French debt, long considered one of the safest in the euro area — arguably second only to Germany’s — has gradually been decoupling as the fiscal picture worsens. The extra yield on 10-year bonds over German securities has doubled from pre-Covid levels.

More notable is the debt’s underperformance versus Spanish, Italian and Portuguese securities, which have lower credit scores. The extra cost paid by Spain to borrow compared to France has almost halved over the past six months.

“What is at stake for France is to understand going forward: do we intend to be closer to Germany or to Italy?,” said Vincent Mortier, chief investment officer at Amundi SA, Europe’s biggest asset manager, which runs over €2 trillion ($2.1 trillion). Italy is one of the most indebted nations in the bloc and its bonds are widely considered some of the riskiest.

Societe Generale’s Kurpiel expects French bonds to continue underperforming, taking the yield premium over German debt toward 60 basis points from around 50 currently. The discount to Spanish debt should eventually vanish, he said.

Many investors are also bearish. AllianceBernstein Holding LP is underweight French bonds versus Germany, pointing to a “gradual deterioration” of the credit rating. Legal & General Investment Management sold French notes to fund long positions on Spain, citing the latter’s superior fiscal metrics.

Rating firms have been flagging risks to France’s credit assessment for months. Fitch downgraded the nation a year ago and in October it issued another cautious note, saying a large and persistent increase in indebtedness could trigger further negative action. JPMorgan Chase & Co. and Commerzbank AG see a possibility the firm will lower the outlook to negative this week.

Moody’s, which has had a stable outlook on France for more than four years, said in late 2022 weakening commitment to fiscal consolidation would increase downward credit pressures. S&P also flagged risks if budget deficits weren’t trimmed, and it’s expected to cut the nation’s score for the first time since 2015 in its next assessment on May 31.

“It would take some analytical gymnastics to affirm the rating at the current level,” said Moritz Kraemer, the former global head of sovereigns at S&P and current chief economist at German lender LBBW. “There’s really nothing that you could say has improved.”

France’s debt-to-GDP ratio rose from around 98% before the Covid pandemic to 110.6% last year and is expected to continue expanding to peak at 113.1% in 2025, according to government projections.

In an annual letter to the French President earlier this week, Bank of France Governor Francois Villeroy de Galhau said debt servicing costs are forecast to rise from €29 billion in 2020 to around €80 billion in 2027.

“The moment of truth has come for a fiscal repair strategy,” Villeroy said.

©2024 Bloomberg L.P.