Mar 14, 2024

Gold Declines After US February PPI Rises More Than Forecast

, Bloomberg News

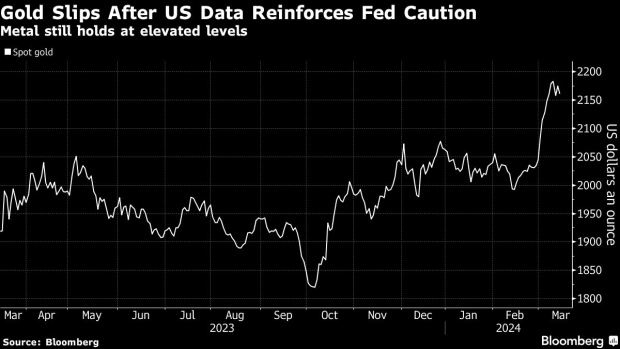

(Bloomberg) -- Gold slipped after new economic data reinforced expectations that the Federal Reserve will be cautious when it comes to lowering borrowing costs.

Prices paid to US producers rose in February by the most in six months, driven by higher fuel and food costs that add to evidence inflation remains elevated. The producer price index for final demand increased 0.6% from January, Labor Department data showed Thursday. The measure rose 1.6% from a year earlier, the largest annual advance since September.

Meanwhile, US retail sales rose by less than forecast after a steep drop to start the year.

Treasury yields and the dollar whipsawed following the data reports, and bullion for immediate delivery fell as much as 0.7% to $2,158.63 an ounce.

The PPI readings plus the consumer price index released earlier this week signal that inflation remains sticky. That makes for a bumpy road ahead for the Fed and its 2% inflation target. Policymakers have said they needed to see more evidence that inflation is headed toward that level before cutting rates. Investors typically start buying gold ahead of rate cuts, since non-yielding assets, like gold and silver, tend to perform well in lower-rate environments.

Fed officials “are and have been cautious for a while. The PPI number did not change that outlook,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

Still, despite the Thursday pullback, bullion is still holding at elevated levels following a prolonged rise. A dip below $2,135 may trigger long liquidation by speculators such as hedge funds and money managers, according to Hansen.

Spot gold fell 0.5% to $2,163.05 an ounce as of 9:33 a.m. in New York. Silver and platinum slipped while palladium advanced.

©2024 Bloomberg L.P.