Jul 16, 2019

Goldman Sachs traders buck Wall Street trend with revenue beat

, Bloomberg News

Goldman Sachs Beats Q2 Equities Trading Revenue Estimate

Goldman Sachs Group Inc. (GS.N) traders surprised investors with a smaller decline in trading revenue than analysts predicted.

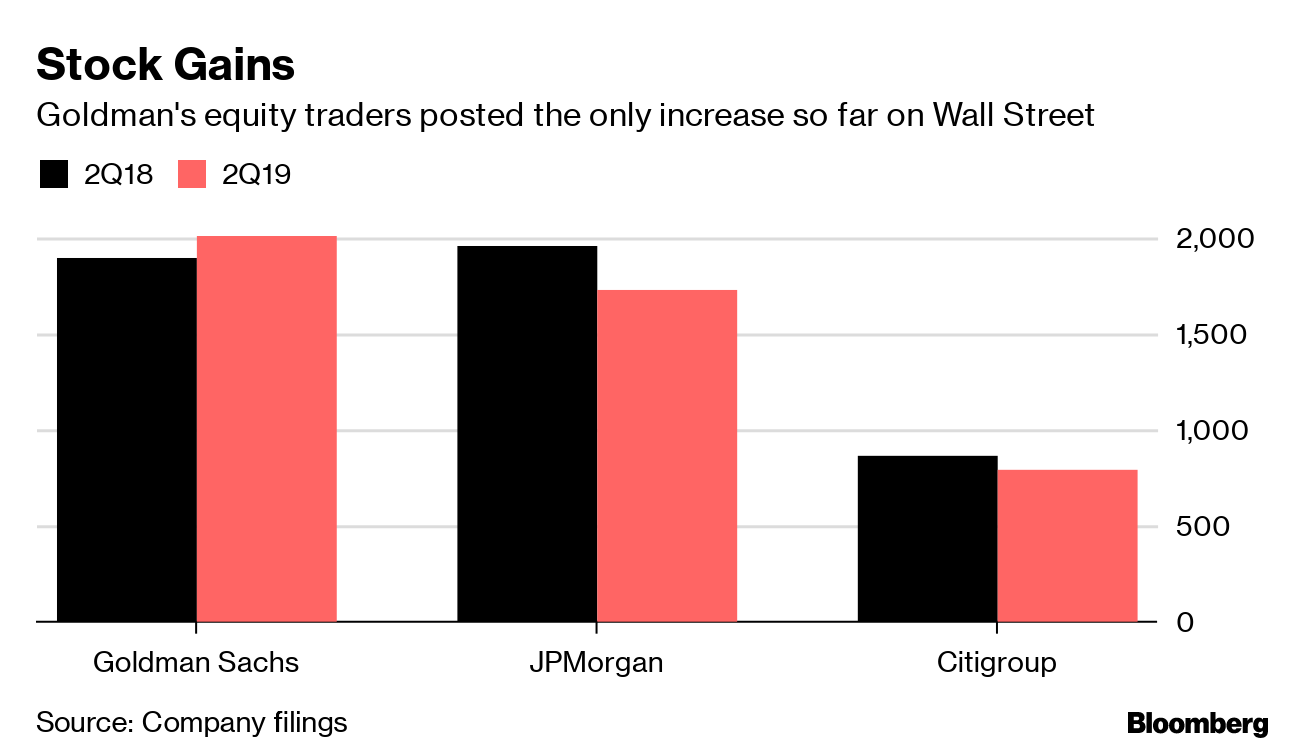

The trading unit, Goldman’s biggest, beat estimates as its stock traders posted an unexpected gain Tuesday for the second quarter. Citigroup Inc. and JPMorgan Chase & Co., which announced results earlier, reported bigger-than-anticipated declines in their trading divisions.

Wall Street executives had warned that a slump in client activity would erode revenue from trading during the quarter. Investors are hanging back amid market swings spurred by the shifting outlook for interest rates, as well as trade disputes and other geopolitical risks.

Last month, Goldman Sachs passed the Federal Reserve’s annual stress test. The exam was easier on capital-markets businesses than in previous years, allowing the firm to increase dividends and share repurchases. It’s a reversal from 2018, when the regulator curtailed the bank’s ability to boost payouts.

Shares of Goldman Sachs have gained 27 per cent this year through Monday, putting it on track for its best annual performance in more than five years. The stock advanced 0.4 per cent at 7:31 a.m. in New York.

Second-quarter trading revenue was US$3.48 billion, topping the US$3.37 billion average estimate by analysts in a Bloomberg survey.

“We’re encouraged by the results for the first half of the year,” Chief Executive Officer David Solomon said in a statement. “Our financial strength positions us to return capital to shareholders, including a significant increase in our quarterly dividend in the third quarter.”

Goldman’s recent foray into consumer banking also has prompted it to heed falling rates. The firm cut the amount of interest it pays depositors with online savings accounts during the second quarter. Banks typically try to maximize the margin between what they pay for deposits and what they earn from making loans.

Goldman also made its biggest acquisition in about two decades with the purchase of a wealth manager to help with its expansion beyond catering to just ultra-wealthy individuals.

Other Highlights

- Equities revenue at US$2.01 billion was the second-highest quarterly performance in four years.

- All elements of investment banking declined in the second quarter from a year ago, led by a 20 per cent drop in debt underwriting.

- Earnings per share of US$5.81 topped the average estimate of US$4.93