Aspiring homebuyers in British Columbia may want to think twice before taking the province up on its offer to help cover the soaring costs of the down payment.

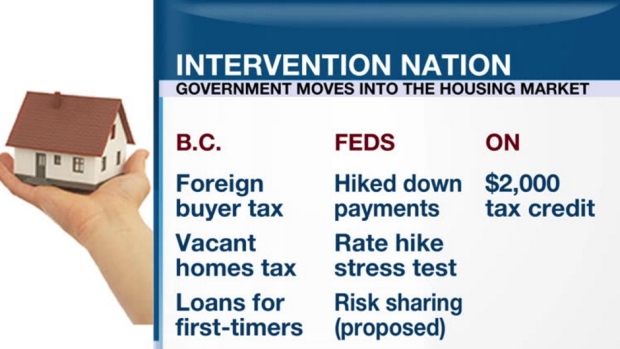

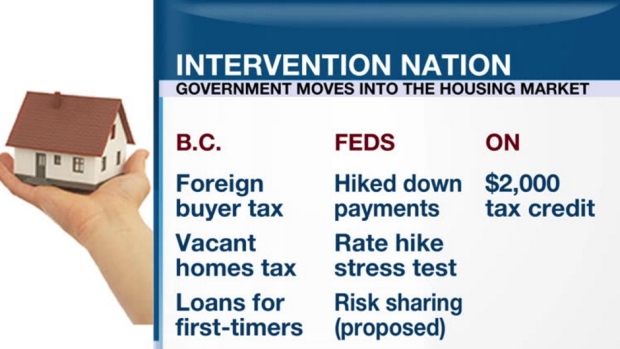

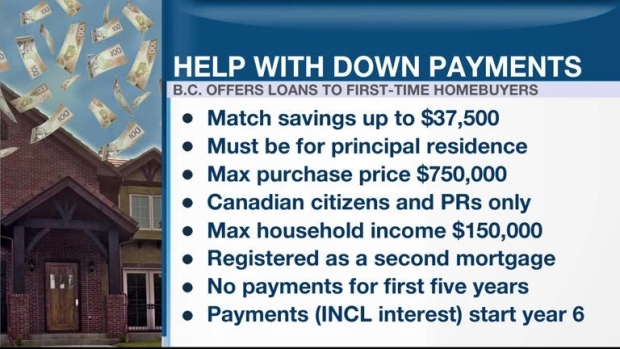

After making several attempts earlier this year to cut demand and thereby slow the meteoric pace of home price increases – particularly in Vancouver – by implementing a surplus land transfer tax on foreign buyers and those who allow homes to sit empty, B.C. is now moving in the opposite direction. The province announced a plan on Thursday to stimulate demand by matching the savings of first-time buyers up to $37,500 in the form of a loan that will require no payments of any kind for the first five years.

There is no shortage of caveats to ensure only certain prospective buyers can qualify – many are laid out in the first chart below – but the most important by far for applicants to consider is the loan is far from free money. It will in fact be registered as a second mortgage and if borrowers decide to take the government up on its offer to wait five years before beginning to repay it, they will find themselves facing interest rates on par with their full mortgage.

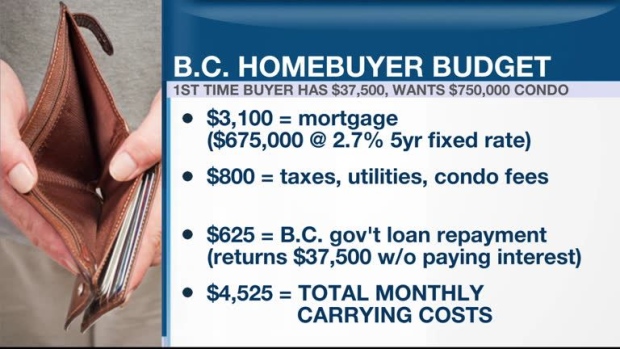

That means any B.C. household hoping to take advantage of the new loan program with a plan to pay it back in the first five years, before interest payments kick in, will need to set aside another $625 every month on top of the various other costs involved with owning a home. How that factors into the monthly carrying costs more specifically is detailed in the second chart below.

After a particularly interventionist year for various governments getting involved in the housing market – a rundown of the biggest moves is detailed in the final chart below – Canadians can expect to find out at some point in 2017 whether or not all this government policy will successfully walk the razor-thin line between allowing home prices to push ever-higher and avoiding an economically devastating price crash.