Apr 9, 2024

How the US Steel Takeover Became About Biden and Swing States

, Bloomberg News

(Bloomberg) -- Takahiro Mori traveled more than 12 hours from Tokyo to Pittsburgh to secure what he hoped would be one of the biggest-ever steel mergers. On the other side of the table from the Nippon Steel Corp. executive sat the one man who now appeared to have the fate of the $14 billion deal in his hands: David McCall, head of the United Steelworkers union.

The Japanese bid to take over United States Steel Corp. had widely been viewed as a slam-dunk offer — the only sticking point was winning over the union and, in turn, its political leverage. Mori assured McCall that Nippon Steel would offer commitments to invest more than $1 billion in the iconic American company while also promising no idling of plants and, most importantly to its workers, no immediate layoffs.

After extending his olive branch, Mori was met with eight minutes of silence as the union read the fine print before a reluctant McCall even responded. The talks dissolved in less than an hour, according to people familiar with the discussions.

Since that fateful March meeting, McCall and the union have continued to slam the deal over labor concerns, even while leaving the door open for more negotiations.

Unions don’t typically hold much sway in the world of takeover battles. But Nippon Steel’s bid to buy US Steel is now caught in an election year maelstrom as President Joe Biden and Donald Trump, in the wake of the union’s objections, have both publicly opposed the deal as they vie for blue-collar votes. The turmoil threatens to strain American relations with one of its top allies while underscoring how the politics of winning swing-state voters is dramatically influencing the corporate landscape.

“It’s a very tough time right now for a marquee-type deal like this to be happening, because there’s politics in every direction,” said Michelle Galanter Applebaum, who covered the industry for four decades as an analyst, including at Salomon Brothers Inc., before retiring.

The political tumult is now background to a planned summit between Biden and Japanese Prime Minister Fumio Kishida in Washington this week — a gathering that’s meant to demonstrate the strength of the alliance. And while the meeting comes just as signs emerge that the steel deal still has a path forward, there are other tensions brewing.

The Biden administration recently enacted an unexpected moratorium on liquefied natural gas export facilities, with the move coming as a surprise to Japanese importers that were in talks to invest in or procure fuel from the facilities. The US also imposed tougher sanctions on a Russian Arctic LNG project vital to Tokyo.

The political outcry came swiftly after Nippon Steel announced its bid in December. That same day, Pennyslvania’s Democratic Senator John Fetterman shot a video from the roof of his Braddock home with a US Steel mill in the background. “It’s absolutely outrageous that they have sold themselves to a foreign nation,” Fetterman said. Others echoed his misgivings, including the state’s other senator, Bob Casey, and Biden’s foremost economic aide, Lael Brainard. Then in March, Biden called for domestic ownership.

“I told our steel workers I have their backs, and I meant it,” Biden said in a statement just one week after the failed meeting between Mori and McCall. US Steel shares fell that day to the lowest since mid-December, just before Nippon Steel announced its offer. The stock is trading more than 20% below the $55-a-share bid.

On Wednesday, Biden reiterated his support for US workers opposed to the Japanese company’s bid, but stopped short of calling again for continued domestic ownership. Kishida, for his part, said he hoped the process would unfold positively. Biden, meanwhile, stressed that the US stands by “our commitment to our alliance” with Japan.

Shares of US Steel rose as much as 1.7% in New York following Biden’s and Kishida’s remarks. While Biden’s comments don’t indicate a substantial change in his stance, he refrained from doubling down on his statement last month that the company must be domestically owned and operated.

The takeover is now going through a secretive national review process, one that’s typically reserved for business involving adversarial nations such as Russia, not countries like Japan, which has served as a key American ally for decades. The outcome of the review by the Committee on Foreign Investment in the United States also has the potential to be contested in court.

“I think they should block the original deal, as announced,” Chris Deluzio, a Pittsburgh-area Democratic congressman, said in an interview, adding: “I imagine, no matter what, the lawyers are going to have their say in either direction here.”

Still, it’s clear that Biden’s motivations aren’t to single out Japan — this is all about winning hearts in places like Pennsylvania.

Trump won Pennsylvania on his way to victory in 2016, and Biden – who was born in the state — won it in 2020. Now on the doorstep of the 2024 rematch, both candidates are wooing the same workers. Trump said he would “absolutely” block the steel deal. Biden called for US Steel to be American-owned, while so far stopping short of an outright pledge to block it.

Even then, Biden’s strong stance against the deal so far isn’t considered its death knell, according to interviews with a dozen people familiar with the discussions. Nippon Steel’s deal may ultimately close for a range of reasons, including because there are problems and trade-offs in every alternate scenario and the potential for litigation over what authority Biden has, they said. Many don’t expect a decision before the US presidential election in November.

“The partnership between Nippon Steel and US Steel reflects the close alliance between Japan and the United States. We are confident that our partnership will protect and grow US Steel,” the companies said in a joint emailed statement. “The deal will protect jobs, strengthen American supply chains, and enhance the competitiveness of the US economy, all while building resilience against threats from China. US Steel’s headquarters will remain in Pittsburgh, and its products – supported by significant capital investments and technology sharing from Nippon Steel – will remain mined, melted, and made in America. ”

To understand why the future of US Steel is so critical to the 2024 election, you just need to talk with the parishioners of the Saints Peter and Paul Byzantine Catholic Church in Braddock, about 10 miles southeast of Pittsburgh. The church was founded in 1896, making it a contemporary of Andrew Carnegie’s first mill. On some sunny days, the towering US Steel facility known as the Edgar Thomson Plant, less than a 10-minute walk away, casts a shadow on the church.

Steel is built into the fabric of towns like Braddock. Pittsburgh’s professional football team is named after the industry (the Steelers), and even while US Steel long ago lost its dominance as the nation’s biggest producer of the metal, it’s still an American industrial icon.

“It’s the history of our town, it’s the history of our families, it’s the history of immigration in this country. Every immigrant group that came to this country they worked in the mills,” said Mary Beth Joscak, 68, a church parishioner with several family members that have worked in the steel mill.

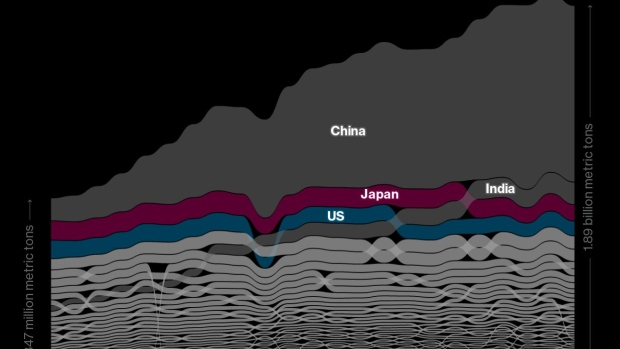

But for all its romance, the industry has seen decades of decline thanks to stiff competition from rival producers in China, Russia and even Japan. Even as recently as 2015, US Steel was posting losses topping $1 billion and left investors worried the company could be on the path to bankruptcy.

“We went through some rough times,” said Rob Hutchison, a 28-year USW member who is an electrical technician at US Steel and a local union grievance chairman.

Partly thanks to wide-ranging tariffs enacted to boost US industries, manufacturing employment during the Trump administration grew to the highest level since 2008, but remained well below the peak reached in 1979. Pandemic-related shutdowns wiped out any progress, with the number of manufacturing employees in April 2020 falling to the lowest since 1941.

And while blue-collar workers remained steadfastly supportive of Trump in 2020, enough of them shifted their support to Biden in 2020 to put the politician over the top. Now on the doorstep of the 2024 rematch, both candidates are pulling out all the stops to woo the critical voting bloc.

Political outcry over the steel deal is quieter outside Pennsylvania. Michigan Senator Gary Peters hasn’t opposed the Nippon Steel deal and said any path forward must protect “American jobs, businesses, and supply chains” and honor union contracts.

For Biden’s part, he’s helped to helm the post-pandemic economic recovery that allowed US Steel to post full-year adjusted profits before some items of $5.59 billion in 2021 – a sharp turnaround from the massive losses less than a decade earlier. The rebound allowed USW members to secure a more than 20% raise, a $4,000 bonus and increases to pension and 401k contributions.

“Coming out of Covid the company seemed to be doing extremely well for the first time in a long time, there weren’t a bunch of financial worries, there weren’t a bunch of people worried about losing their jobs,” Hutchison said during an interview at the USW’s historic downtown Pittsburgh office building. “Then suddenly out of nowhere within the plant we all started to get this message that they were talking about selling the company.”

What the workers fear is not just losing their jobs, but also some of the protections that come with being union members, such as retirement benefits.

Only about half of US Steel’s workers are members of the USW. Part of that is because a large number of workers aren't steelworkers, but hold typical office jobs. The division among steelworkers comes down to those employed at plants that use traditional blast-furnace production of steel from iron ore, which are typically unionized, and the growing number that are at the more modern and less-polluting plant that remelts metal scrap instead — a so-called mini mill that isn’t unionized.

In late 2020, US Steel announced the full purchase of a state-of-the-art and non-unionized mini mill and announced plans to pour in an additional $3 billion to double capacity at the facility. The plant, called Big River Steel and located in Osceola, Arkansas, instantly became the crown jewel of the company. The purchase cemented Chief Executive Officer David Burritt’s reputation and many in the broader industry felt the pivot saved the company. But to pay for it, Burritt canceled a $1.3 billion plan to upgrade union-run Mon Valley, the flagship Pennsylvania plant where Carnegie built his first mill in the 1870s.

The move was the first of what the USW has seen as the company's anti-union trend.

In recent years, US Steel idled production at its Granite City plant in Illinois and Great Lakes Works in Michigan, which are unionized plants. The company hasn’t shown any indication it wants to ramp those sites back up. In 2022, then-president of the USW Tom Conway (who has since passed away) put it bluntly in an interview with Bloomberg: “Clearly going to Arkansas is also a strategy to avoid a union. They’re not going into the Gary, Indiana, region or back into Detroit where you took steelmaking down, or Northeastern or Midwestern states where there’s unions.”

Nippon Steel’s original offer to US Steel, during the American company’s strategic review to sell all or parts of the business, was to buy the Arkansas mill and some iron ore mining operations at $9.2 billion. It’s a point not lost on Don Furko, president of USW Local 1557, who sported a union t-shirt during the interview that Hutchison was also part of.

Furko and Hutchison echoed Biden by saying they want US Steel to be American owned — but they also are quick to point out that their bigger concerns are about jobs. It’s a sentiment that’s been echoed by other workers, union officials, area residents and also by some of the politicians.

“We felt that if the company was to be sold we want it to be to a company who would invest in our legacy facilities,” like the union shops such as Mon Valley, Furko said. “Anything that would keep us out of the cross hairs — that would be good.”

McCall has called the latest overtures by the Japanese company to win his support “meaningless.” Nippon Steel made what it called a binding commitment to the influential union in a March 27 letter. McCall dubbed it “another collection of empty promises and open-ended language that would enable it to skirt obligations to workers and retirees.”

McCall and the USW also continue to publicly back US-based Cleveland-Cliffs Inc., which had also pursued a purchase of US Steel.

Cliffs CEO Lourenco Goncalves, whose original public offer for US Steel in August was what effectively first sparked the takeover saga, is now teasing another bid. He’s said his company is the only one that has the backing of the USW.

“He’s made real commitments to us about capital investments in the facilities and steelmaking operations and blast furnace operations in this country,” McCall said in a recent interview with Bloomberg News. “That’s important to us.”

Conversations with McCall over the last few months reveal a decidedly different tone when he speaks about Nippon Steel versus Cliffs.

Back in March, McCall opened the meeting with Mori and other Nippon Steel officials with a jab: “Why didn’t you call us when you knew you were going to buy US Steel?”

Still, McCall is also aware that Goncalves has his own shareholders to answer to.

“First of all he’s the CEO of a major employer, so he represents the employer,” McCall said. “Sometimes we can easily align with him and what he represents, and sometimes we don’t.”

A spokeswoman for Cleveland-Cliffs wasn't available for comment.

Analysts, officials and others following the deal closely tend to agree on one thing: the deal isn’t necessarily dead, but its path is unclear. Several options remain: Nippon Steel succeeds in buying US Steel, including through a potential legal fight; Cliffs or another entity buys it instead; everything collapses and US Steel remains independent; or it’s split among buyers. All have risks, complications and political headaches.

Another bid from Goncalves would likely come at a lower price, and also carry serious antitrust concerns.

Combining Cliffs and US Steel would mean the combined company would hold 100% of US iron ore reserves and integrated mills, and become the primary supplier of coveted automotive steel – a prospect the auto sector, which has its own political clout, has warned against. US Steel and its advisers repeatedly flagged “substantial” antitrust concerns about selling to Cliffs, saying it would require $7 billion of divestitures, far from the $2 billion that Cliffs had proposed.

“You could slice this deal so many different ways and come up with a different problem,” Applebaum, the retired analyst, said of the overall US Steel situation.

Statements from Nippon Steel, meanwhile, offer no hint of retreat. Given that Nippon Steel would owe a $565 million breakup fee if the deal fails, it would make more sense for the company to promise a $50,000 bonus to each unionized steelworker to save the negotiation, investors have said.

Even McCall himself this week in an interview agreed with steelworkers and retirees who spoke to Bloomberg News that keeping union jobs, keeping the US Steel mills open and securing specific investments that will ensure another generation of life at the blast furnaces is what's most important to him, regardless of who the buyer is for US Steel.

William Chou, Japan chair fellow at the Hudson Institute think tank, said Nippon Steel will continue to focus its advocacy on union members. Though the review timeline remains unclear, Biden has stopped short of formally ending the deal. “Until that happens, I expect Nippon Steel to push for a deal, given its faith in the US market and the quality of its steelmaking technology,” Chou said.

What does look clear for now, is that the voices that seem to have the strongest sway aren’t in the boardrooms. They’re back in Braddock, waiting to be won over by Biden. The president was born about 270 miles away in Scranton, Pennsylvania, and invokes blue-collar hardships of his childhood in almost every unscripted speech.

“My grandfather came to Braddock in the 1890s,” said Bill Mistick, a third-generation resident of the area. “And he worked in the mill, got killed in the mill. Several uncles worked in the mill – one lost several fingers.”

“The piece that’s really important is the union and union jobs and union strength, so the middle class can really afford to live and have a pension,” he said.

--With assistance from Yasufumi Saito.

(Updates with latest Biden, Kishida comments from Wednesday in 11th paragraph)

©2024 Bloomberg L.P.