Apr 17, 2024

IMF Says US, China Debt Pose Risks for Global Public Finances

, Bloomberg News

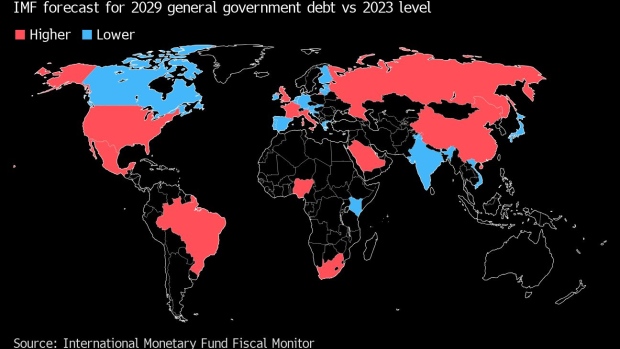

(Bloomberg) -- The world’s two great economic rivals, China and the US, will drive much of the increase in global public debt over the next five years, with American spending creating trouble for many other countries by keeping interest rates high, officials at the International Monetary Fund said.

“In both economies, public debt is projected under current policies to nearly double by 2053,” the IMF said in its Fiscal Monitor, an overview of global public finance developments. “How these two economies manage their fiscal policies could therefore have profound effects on the global economy and pose significant risks for baseline fiscal projections in other economies.”

Higher interest rates in the US make life difficult for many countries by strengthening the value of the US dollar against other currencies, making dollar-priced commodities more expensive and increasing debt burdens for countries that have borrowed in the US currency.

“High and uncertain interest rates in the US affect the cost of funding elsewhere in the world,” Vitor Gaspar, director of fiscal affairs at the IMF, said in an interview. “The impact is quite significant.”

As for China, the fund warned that a larger-than-expected slowdown in China — “potentially exacerbated by unintended fiscal tightening given significant fiscal imbalances in local governments” — can create risks for the rest of the world through lower levels of international trade, external financing and investments.

The report projected overall primary deficits would decline to 4.9% of global GDP this year from 5.5% in 2023, but with substantial risks threatening public finances in many countries.

The IMF also singled out the UK and Italy alongside the US and China as nations that face serious fiscal risks as debt continues to creep upwards. The four countries were driving global debt levels close to 100% of GDP and they “critically need to take policy action to address fundamental imbalances between spending and revenues,” the IMF said.

IMF officials specifically criticized £20 billion ($25 billion) of cuts to payroll taxes in UK Chancellor of the Exchequer Jeremy Hunt’s two most recent fiscal statements. Such recent policy changes, “although part-funded by well-conceived revenue-raising measures, could worsen the debt trajectory in the medium term,” the report said.

Asked about the risk of rising debt during an Institute of International Finance event in Washington on Wednesday, Bank of England Governor Andrew Bailey said public sector funding played an important role in addressing big challenges such as the pandemic, rising security risks and climate change.

“We do have to look at it. It is important. It is a big-subject conversation,” Bailey said. “But I come back to this point: If you are living in very volatile times, then there are of course very big demands for response from policy.”

The IMF noted that voters this year will go to the polls in 88 economies representing more than half of the world’s population and GDP, in what has been termed the “great election year.”

“Support for increased government spending has grown across the political spectrum over the past several decades, making this year especially challenging,” the report said. “Fiscal policy tends to be looser, and slippages larger, during election years.”

--With assistance from Zoe Schneeweiss, Craig Stirling and Philip Aldrick.

(Updates with further details and UK context from seventh paragraph.)

©2024 Bloomberg L.P.