Apr 19, 2024

India Rate Setters Counting on Healthy Growth to Lower Inflation

, Bloomberg News

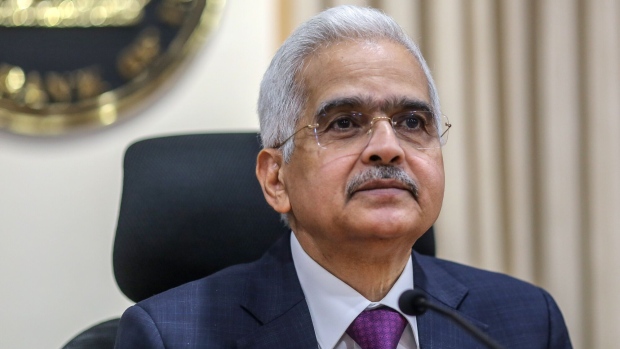

(Bloomberg) -- Strong growth is allowing India’s rate-setters to maintain interest rates higher for longer to ensure inflation is lowered in a durable manner, the minutes of the monetary policy meeting showed Friday.

The Reserve Bank of India’s monetary policy committee voted five-to-one to keep the benchmark repurchase rate unchanged at 6.5% and retain its policy stance of “withdrawal of accommodation.”

Economic expansion at an average of 8% in the past three years and expectations of good growth in the current year “give us the policy space to unwaveringly focus on price stability,” said Governor Shaktikanta Das. Inflation is cooling, but the success “should not distract us from the vulnerability of the inflation trajectory to the frequent incidences of supply side shocks, especially to food inflation due to adverse weather events and other factors.”

Warmer-than-normal temperatures across large parts of the country risk keeping food prices higher, even though core inflation, which excludes volatile food and fuel components, is softening. India’s retail inflation eased to a 10-month low in March, inching closer to the RBI’s 4% target.

While a forecast for abundant monsoon rains provides some relief, the tensions in the Middle East may keep the rate panel cautious going ahead. Economists, including those from Morgan Stanley are starting to push back their expectations for rate cuts to later in the year.

Das’s deputy Michael Patra said moderating core inflation and fall in fuel prices might not “assure a faster alignment of the headline with the target.” Consumer price index may continue to remain high till at least September and hence, “conditions are not yet in place for any let-up in the restrictive stance of monetary policy.”

Jayanth Rama Varma, who voted for a quarter point cut and change of stance to neutral, said real interest rate, or the inflation adjusted policy rate, of 1%-1.5% “would be sufficient to glide inflation to the target of 4%,” but the current real policy rate of 2% is “excessive.”

Here’s what other members in the panel said:

- Shashanka Bhide, an external member in the panel, said food inflation trends would remain crucial for RBI’s inflation target, and there are significant risks “given the uncertain weather events and geo-economic conflicts affecting supply chains.”

- Ashima Goyal, another external member in the panel said monetary policy would still remain ‘contractionary’ despite a cut in repo rates, but amid current uncertainties, “maintaining stability must have priority.”

- Rajiv Ranjan, an executive director at RBI, said while low core inflation helps in disinflation, concerns remain on food inflation outlook and that “RBI must remain watchful on upside risks to inflation outlook from adverse climatic factors, supply side shocks and geopolitical events.”

©2024 Bloomberg L.P.