Mar 28, 2024

India’s ‘Unbeatable’ Bond Valuations Make Them Vontobel Top Pick

, Bloomberg News

(Bloomberg) -- Sign up for the India Edition newsletter by Menaka Doshi – an insider's guide to the emerging economic powerhouse, and the billionaires and businesses behind its rise, delivered weekly.

Vontobel Asset Management is boosting its India local-currency bond holdings, touting their attractive valuations and imminent inclusion in an important set of global bond indexes.

The country’s debt is “unbeatable” on valuations, said Thierry Larose, the Zurich-based manager of the $230 billion firm’s Sustainable Emerging-Market Local-Currency Bond Fund and Emerging-Markets Blend Fund. Both funds outperformed 90% of their peers last year, according to data compiled by Bloomberg.

Wall Street investors have been increasing exposure to Indian assets, attracted by one of the world’s fastest economic growth rates and a low correlation with global markets including other developing nations. Foreigners own just 2% of India’s government bonds, one of the lowest ownership rates among emerging markets.

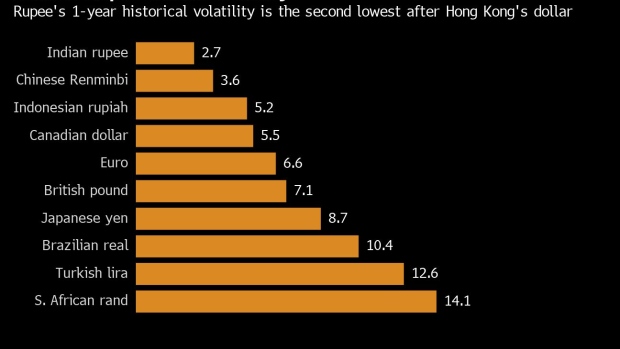

Meanwhile the nation’s trillion-dollar sovereign bond market is gearing up for a rush of foreign money when it’s added to JPMorgan Chase & Co.’s emerging-market bond indexes in June. India’s two-year bonds are priced to yield 7.1% against an inflation rate expected to slow to 4.5% in 2025 from 5.7% last year, and the rupee’s 1-year historical volatility is the lowest among 31 major currencies after the Hong Kong dollar.

“We like India, we think that from a valuation perspective the country is unbeatable,” Larose said in an interview, citing inflation and volatility-adjusted carry. “The Indian currency is extremely stable and the rates on offer are over expected inflation rate, making it the most attractive market for us.”

That contrasts with India’s equity valuations, among the most expensive in the world. The S&P BSE Sensex’s earnings yield, at 4.9%, pales before the benchmark 10-year bond yield at 7.1%, meaning investors are not compensated for the extra risk they take with stocks. Heady equity gains have prompted warnings from investment banks including Citigroup Inc. and Societe Generale, and also the attention of local market regulators.

Best Returns

Among investment-grade emerging markets, India’s local bonds have generated the best returns this year with an average yield topping 7%, the third highest rate on offer among peers, according to a Bloomberg index tracking emerging-market debt. Indian bonds are likely to attract some $100 billion of foreign flows in the coming years after their inclusion in JPMorgan indexes, according to HSBC Asset Management.

“Right now there are many who are unable to buy because the setup of an account takes a long time and so we haven’t seen much flow into the local bond market, but we believe it is going to be an incremental progress,” Larose said.

Emerging-market local bonds overall are are in red for the year amid lingering uncertainty over the timing and pace of US interest-rate cuts and losses in every emerging-market currency except for the Mexican peso. That makes Larose cautious about taking any oversized bets.

“We try to be as diversified as possible because this is a time when it is easy to get trades wrong,” he said.

Other Markets

Vontobel has also increased exposure to South Africa local bonds, while reducing exposure to Brazil, where Larose cites concerns about government meddling in central bank policy and management of state-owned companies.

Another market he says he’s been watching is Turkey, where local bonds have lost almost 9% even as the central bank raised interest rates by 30 percentage points since June.

“Turkey has been a disappointment so far this year because at the start of 2024 our view was that it could have been a great turnaround story,” he said. “But inflation has proven to be more sticky than expected and local bonds aren’t performing well. This can still change but we are in a more wait and see approach on Turkey now.”

--With assistance from Srinivasan Sivabalan.

©2024 Bloomberg L.P.