Mar 19, 2024

Israel's Ban on Palestinian Workers Is Hurting Both Economies

, Bloomberg News

(Bloomberg) -- For Fadi Sajdia, a construction laborer from the West Bank city of Ramallah, the Muslim holy month of Ramadan should be a time of daily fasting and nightly feasting. But like 150,000 other Palestinians who worked in Israel until the Hamas massacre in southern Israel in October, he’s out of a job.

“I’m the sole breadwinner in my family,” Sajdia, 37, said. “Now we only buy essentials.”

All across Israel, building sites are idle as a ban on Palestinian workers continues with no end in sight. It’s turned the bellwether construction industry into an economic-crisis epicenter, offering a glimpse of what awaits both sides if the war in Gaza permanently ruptures their precarious ties.

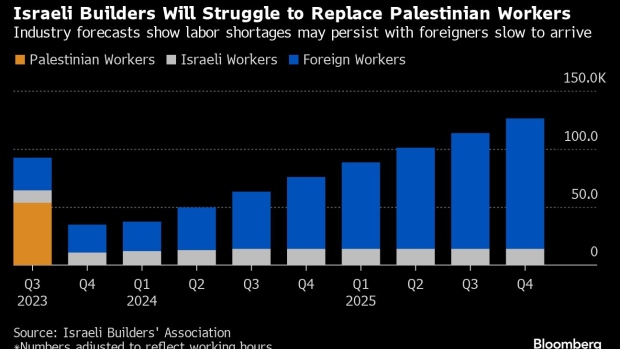

A painful decoupling between the two economies has threatened a lifeline for Palestinian territories and left Israeli builders scrambling for labor abroad — a shift in the workforce that industry forecasts show will take a year, at best, to complete. More than two-thirds of Palestinians employed in Israel before the war worked in construction.

After the Oct. 7 Hamas attack that provoked the war in Gaza, Israeli authorities instituted a complete shutdown of borders with the West Bank over security concerns. The government has since then tripled to 65,000 the quota of foreign workers allowed to enter Israel, mainly from India and Sri Lanka. But so far only 850 have arrived.

The plight is tangible on both sides of the divide.

Israel’s Finance Ministry estimates the absence of Palestinian workers in construction, agriculture and industry is costing 3 billion shekels ($840 million) in lost output a month.

Economic shockwaves from the war have been far more devastating in Palestinian territories, with a humanitarian crisis is unfolding in Gaza. Fighting is still raging there and the Israeli government’s vowed to press on with its campaign against Hamas — designated a terrorist organization by the US — by sending troops into the southern city of Rafah, despite mounting global opposition to that plan.

In the West Bank, where 17,000 Palestinians are still working in Jewish settlements, unemployment has more than doubled to over 30%.

Before the war, a fifth of all employed residents of the West Bank worked in Israel or its settlements, where they earned more than twice the average domestic wage, according to the United Nations. Their earnings totaled around $4 billion annually, equivalent to a quarter of local gross domestic product.

The shock of the October assault by Hamas, during which 1,200 people were killed and 250 abducted, has created suspicion among some Israeli Jews that other Palestinians might be preparing attacks of their own. Israel’s retaliatory air and ground attacks in Gaza have killed over 31,000 people, according to the Hamas-run Health Ministry.

Tensions have escalated in the West Bank, which is ruled by the Palestinian Authority but still largely controlled by the Israel Defense Forces. Hundreds of Palestinians have been arrested by the IDF following what it called attacks on Israeli civilians and soldiers. Settler violence against Palestinians has also been on the rise.

Read More: Freshly Downgraded Israel Readies Bond Spree to Pay for War

The employment of Palestinian workers from the West Bank has gradually expanded over the past two decades, partly in response to demand for low-wage manual workers in Israel, now one of the world’s richest countries. Until last October, about 156,000 Palestinians were employed in Israel.

For workers from Gaza, the border with Israel had been shut since 2005. Only a limited portion of a maximum 20,000 workers were allowed to enter Israel in recent years.

Path Ahead

The problems go far beyond economics. If there’s no resolution, it would potentially jeopardize cooperation between the Israeli and Palestinian security forces.

Some on the Israeli right are calling for authorities to seize the opportunity and sever ties. “Israel should cease employment of Palestinians and bring in skilled workers from other countries,” said the National Labor Federation, a small trade union of 100,000 workers.

That isn’t the view of Israel’s security establishment, which until the current war was careful to argue in favor of preserving Palestinian employment even in times of heightened tensions.

It’s now recommending a careful, gradual return of the Palestinians, partly to stabilize the West Bank. So far, Prime Minister Benjamin Netanyahu’s right-wing government appears to have the public behind it as it keeps the workers out.

Prior to Oct. 7, Palestinians made up one of every three construction workers in Israel. They dominated early stages of building work, meaning little can proceed without them. Some 40% of construction sites are shut; the rest have only partially resumed.

Read More: Biden and Bibi Back Off Their Feud But Suspicion Lingers at Home

It’s a similar situation with Israel’s infrastructure sector, which can no longer count on roughly 10,000 Palestinian workers it employed before the war. The needs are even more urgent because multiple sites require repairs after being hit by missiles fired from Gaza and Hezbollah militants in Lebanon.

Construction, while accounting for only 6% to 7% of GDP, accounted for almost half of the near-record drop in growth over the last quarter of 2023.

“It’s like a millstone on the economy that can cost Israel some 1.5%-2% of its GDP in the coming year or longer,” said Adi Brender, the central bank’s head of research. A construction downturn is among a handful of factors that can hold back a broader recovery, he said.

Knock-On Effects

Israel’s high-flying economy of the past two decades — with GDP per capita passing those of the UK and France, thanks in large part to a booming high-tech sector — has involved rapid expansion of roads and housing. Now that those industries are at a near standstill, the knock-on effects will be widespread.

Over two-thirds of local factories that supply the construction industry reported sales drops of more than 50% in January. The head of Israel’s Manufacturers’ Association, Ron Tomer, has warned of shutdowns and layoffs and “a dependency on imports from unfriendly countries like Turkey and China.”

Another concern is that property prices will soar, piling pressure on renters and homeowners in what’s already one of the world’s most expensive real estate markets.

The contagion from the building industry’s woes could eventually pose a risk for otherwise solid lenders. The construction and real estate sectors accounted for up to 26% of the gross loans at Israel’s five largest banks as of September 2023, according to Moody’s Investors Service.

Aharon Galili, the owner of a 40-year-old building firm, had to shut down a site for 100 housing units. “I am still forced to pay huge interest on loans,” he said. “I may survive, but some can’t handle that.”

Economic Scarring

In the West Bank, an economic parting of the ways is taking a heavy toll. The area has been under a security lockdown since mid-September, and unrest has grown since Israel’s airstrikes and near-total blockade on Gaza began five months ago.

Palestinian GDP contracted an annualized 33% in the last quarter of 2023. A third of businesses report being completely or partially closed.

The financial plight of the Palestinian Authority is worsening. It’s refused to accept the tax revenues that Israel collects on its behalf because Israeli authorities are deducting funds designated for Gaza, which is still nominally run by Hamas. As a result, the authority can only pay 60% of its employees’ salaries, Palestinian Economy Minister Khaled al Osaily told Bloomberg.

Israeli businesses and Palestinian households will struggle to cope if the West Bank descends into a deeper isolation.

For now, there’s no sign of a major return of the workers to Israel. As Eli Cohen, Chief Executive Officer of Termokir, a factory that supplies the construction industry, sees it, the change is probably here to stay.

“This is a real breaking point,” he said. “Things will not go back to the way they were soon and even if some restrictions are lifted it will be a very limited process.”

©2024 Bloomberg L.P.