Mar 25, 2024

Junk Market Flashes Warning as Fed Eyes Higher Rates for Longer

, Bloomberg News

(Bloomberg) -- Junk-rated US companies have seen their interest costs rise after the Federal Reserve’s rate-hike campaign, but profits haven’t kept up, putting a squeeze on finances and underscoring a key risk for investors in high-yield debt as the trend persists.

The ratio between companies’ earnings and their interest expense has fallen to the lowest level since the pandemic, signaling they have less income to service their debt. The so-called debt-service coverage ratio averaged just 3.5 times for the median company in the leveraged-loan universe at the end of September, according to Torsten Slok, chief economist at Apollo Global Management, down from more than 5 times a year earlier.

The deterioration is a knock-on effect of the Fed’s months-long campaign to combat inflation by raising its key benchmark rate by some 5 percentage points since 2022. While central bankers reiterated at a policy meeting last week that they expect their next move will be a rate cut, Chair Jerome Powell hesitated to say when reductions would start, noting that the data supported a Fed’s cautious approach.

Higher-for-longer rates mean borrowers will continue to feel the pinch long after the rate-hike cycle is over. Though the latest debt-service ratios aren’t dire, the expense adds up, and it’s a pressure that can factor into ratings downgrades and even force corporate defaults. Once a company’s debt service coverage ratio falls below 2 times, it often struggles to refinance maturing loans and bonds, said Christian Hoffmann, portfolio manager at Thornburg Investment Management.

“It’s been nearly a year of what’s likely peak rates,” Hoffmann said. “As the Fed keeps rates pinned higher, leveraged loan borrowers will continue to feel pain.”

Already, the US leveraged loan default rate has climbed to 6.22% as of Feb. 29 from 6.16% a month earlier on a trailing 12-month basis, coming closer to the peak rate of 7.7% during two of the last three recessions, according to TD Securities Inc. strategist Hans Mikkelsen. The bank’s model predicts further increases, he wrote in a note on Friday.

“The stress from prolonged higher cost of capital is evident as default volumes continue to rise.” Lyuba Petrova, managing director at Fitch Ratings said last week.

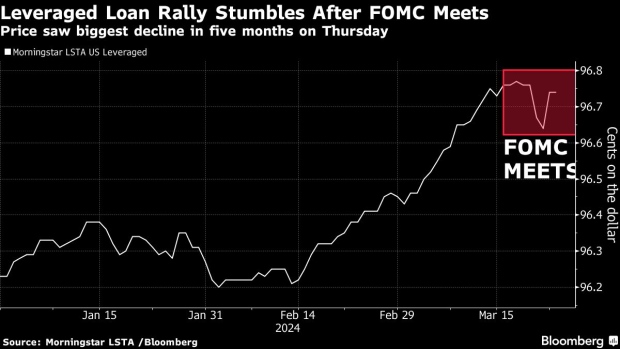

For now, money managers don’t seem overly fearful of lower debt-service coverage ratios. The average loan was priced at about 96.6 cents on the dollar on Friday, close to its highest levels since May 2022, according to the Morningstar LSTA US Leveraged Loan Price Index. And a measure Barclays uses to reflect complacency in credit markets spiked to the highest since January 2022.

There are some signs of concern, though. On Thursday, the day after the Fed meeting, the average leveraged loan price had its biggest decline in five months. And Bank of America Corp. strategist Oleg Melentyev wrote in a note Friday that most of the refinancings seen in the loan market this year were at the highest quality segments first, before expanding to mid-quality in the last few months.

“Lowest quality market access remains substantially constrained,” Melentyev wrote.

The problem is more pronounced in loans than in high-yield bonds, because loans are usually floating-rate obligations, meaning their interest costs are adjusted higher more quickly in an environment of rising rates than fixed-rate bonds.

“The loan market from a coverage ratio is much worse off than high yield,” said John Lloyd, lead for the multi-sector credit strategies and a portfolio manager at Janus Henderson. “The evidence of that is that you’re seeing many more downgrades and slightly higher defaults in leveraged loans than you are in high yield.”

While fixed-rate borrowers are more insulated from the rate-hike cycle, they will be subject to the same pressures when they need to refinance, assuming the rate backdrop doesn’t change.

“Stress will intensify for those borrowers that are not bringing leverage down to maintain adequate coverage ratios,” said Bill Zox, a portfolio manager at Brandywine Global Investment Management. “If borrowers have their heads buried in the sand, betting on much lower base rates, I am a seller.”

(In story that ran on March 25, corrects spelling of name in fifth paragraph)

©2024 Bloomberg L.P.