Apr 26, 2024

Key Measure of Bitcoin Mining Profitability Nears All-Time Low

, Bloomberg News

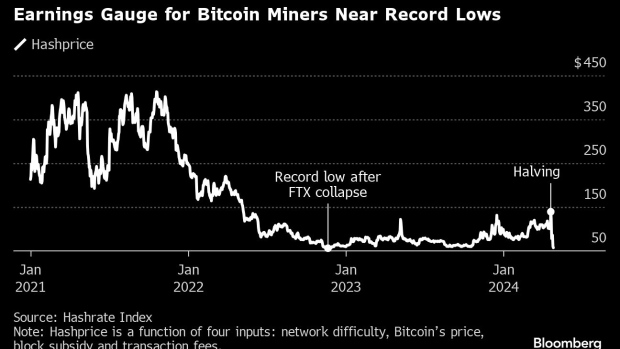

(Bloomberg) -- A metric providing a window into the profitability of Bitcoin mining is approaching the all-time low it reached after the collapse of Sam Bankman-Fried’s FTX, signaling hard times ahead for miners.

The sharp drop in the so-called “hashprice” comes on the heels of Bitcoin’s fourth “halving,” which on April 20 cut in half the reward miners earn for their work securing the network.

The quadrennial event has historically been a tailwind for Bitcoin, but it had a minimal impact on the cryptocurrency this time around. Instead, geopolitical tensions and expectations of higher-for-longer US interest rates have weighed on Bitcoin and other cryptoassets.

Read more: What Is Bitcoin ‘Halving’? Does It Push Up the Price?: QuickTake

The hashprice — a term coined by crypto firm Luxor Technologies — fell to $57 on Friday, according to Hashrate Index data. The figure represents the amount a miner can expect to earn from one petahash per second of computing power per day. It touched an all-time low of $55 shortly after FTX’s implosion in November 2022.

The hashprice briefly jumped to as high as $139 immediately after the halving, as transaction fees soared thanks to a flurry of activity surrounding the Rune protocol, which allows people to create nonfungible tokens on the Bitcoin blockchain. The jump quickly reversed as fees dropped back to pre-halving levels and mining difficulty increased, according to CryptoQuant data.

With the core task of Bitcoin mining now considerably harder and rewards slashed, miners are more reliant than ever on fee revenue and gains in the token’s price.

To prepare for a potential shakeout, bigger miners such as Marathon Digital Holdings Inc. and Riot Platforms Inc. have spent billions of dollars purchasing mining equipment and building out data centers. Smaller and less well-resourced outfits, however, risk getting squeezed out of the market.

©2024 Bloomberg L.P.