Jul 20, 2016

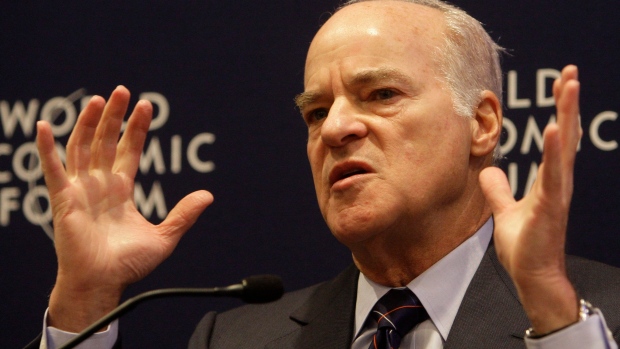

KKR co-founder Henry Kravis urges 'amateur' investors to step aside amid Brexit fallout

BNN Bloomberg

One of the most iconic names on Wall Street has a warning for investors: This can’t be amateur hour in the markets.

“This is not a time for a lot of amateurs to be investing,” KKR co-founder Henry Kravis is quoted as saying Wednesday at a luncheon in Hong Kong.

Global stocks plunged in the immediate aftermath of the United Kingdom’s vote on June 23 to separate from the European Union. But in the following weeks, markets have largely recovered from the shock of the Brexit referendum. The Toronto Stock Exchange was sitting almost 400 points above its post-Brexit low as of the close of trading Tuesday, and the Dow Jones Industrial Average has surged into record territory amid its longest winning streak since 2013.

But Kravis, a pioneering force in the private equity landscape, said he is bracing for long-term volatility as the United Kingdom navigates its exit from the EU.

“I think Brexit is going to be a dislocation for a long time,” Kravis added. “I think you’ll see it more in the next 12-to-24 months more than you’ll see it today.”

More to come