Feb 26, 2024

Larry Berman: Market breadth improving – not bullish, but not bad

By Larry Berman

Larry Berman's Market Outlook

Looking at market breadth can often provide insight into whether or not a market trend can continue. When we look under the hood of the market, all should know that the Magnificent 7 (MAG 7) have been doing much of the lifting since Microsoft invested in Chat GPT in early 2023 igniting the AI boom.

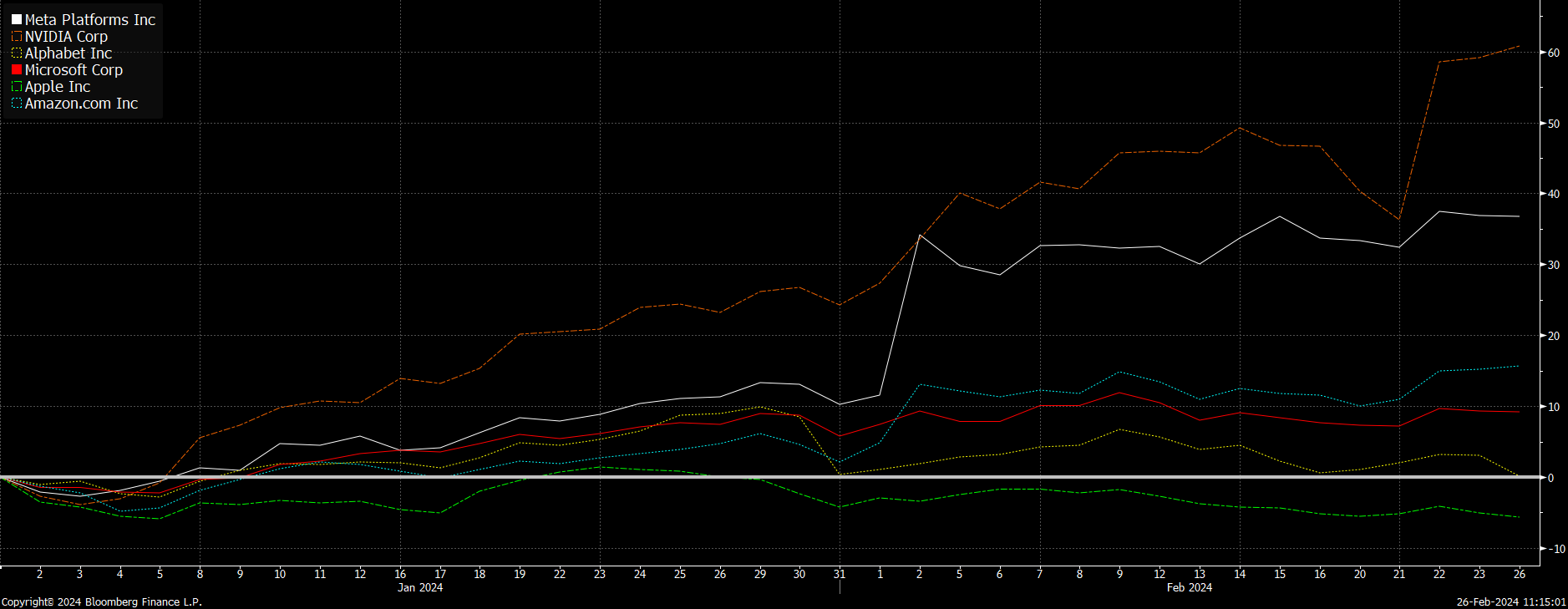

In recent weeks, it’s more like the Magnificent 4, with APPL, GOOL, and TSLA all down on the year or close to it.

The strength of the U.S. economy and the FOMC member messaging pushing back expected rate cuts complicates the analysis. The rebalancing of the global supply chain with a trend towards less globalization and more nationalism (just in case inventories versus just in time inventories) adds a degree of uncertainty and is more inflationary.

The fact that the U.S. economy is still at full employment is great for demand, but we can see in the bottom cohorts of real income earners that credit expansion is now funding consumption. Most of the job gains in 2023 have been part-time in nature and likely second jobs for many. The breadth of the economic expansion is narrow too, and that is a risk to the trend as well.

When we look at the MAG 7 YTD, we can see that NVDA and META are the standouts, with MSFT and AMZN delivering solid returns, but still a significant distance behind. So even the leadership group is showing weaker breadth. Everyone wants to own what’s working. Group think and momentum are compelling behavioural influences. When we look at the EPS growth for the market overall, it’s highly concentrated in a few names.

You may have heard the term a rising tide lifts all boats. The same is true when we evaluate market breadth. A strong healthy market based on a strong economy and strong fundamentals lifts all boats.

A weak bifurcated economy like we have now sees fewer winners and more losers. With our Berman’s Call PRO-EYEs indicator at highly cautious levels where forward-based returns tend to be negative, it’s hard to buy into what the market cap indexes are suggesting.

It should be no surprise why Warren Buffett has so much cash around.

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman

www.etfcm.com