Mar 15, 2024

Legacy Bitcoin Funds Bleed Cash After Blockbuster US ETF Launch

, Bloomberg News

(Bloomberg) -- The frenzy for spot-Bitcoin ETFs in the US is taking a heavy toll on years-old investment products that had led the way in bringing cryptocurrencies to the fund world.

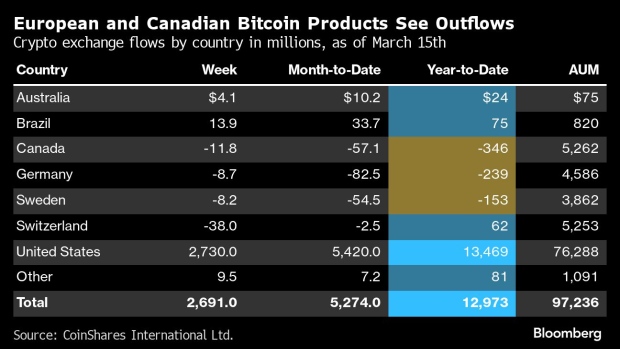

Investors have pulled a total of $738 million from Bitcoin vehicles on German, Canadian, and Swedish exchanges so far in 2024, according to data from CoinShares International Ltd. As Bitcoin marks new all-time highs, the majority of exiting investors are likely switching from one Bitcoin product to another in pursuit of lower management fees, according to Stéphane Ouellette, chief executive officer at FRNT Financial Inc.

“American investors, who had previously managed to buy Bitcoin-ETPs on other exchanges, are highly likely candidates to have repatriated their investment dollars to US ETFs,” Ouellette said.

Toronto-based Purpose Investments Inc., which launched its Bitcoin ETF offering on the Toronto Stock Exchange in early 2021, charges a 1% management fee — four times higher than BlackRock Inc.’s equivalent fund which was approved in early January. While the BlackRock Bitcoin Trust has seen over $12 billion of inflows since the start of the year, Purpose Investment has seen $369 million of outflows, according to CoinShares data.

Similar offerings from XBT Provider AB, a Swedish-based issuer of exchange traded products owned by CoinShares, have seen $182 million of net outflows since the start of the year.

James Butterfill, head of research at CoinShares, acknowledged some of the outflow could be “reshoring” by US investors, but said it could also be down to profit-taking by long-term investors as Bitcoin rallies.

“All these markets have had ETPs for many years now, unlike the US, so there is probably an element of profit taking at these levels,” Butterfill said.

The pace of outflows appears to be slowing. Across German, Canadian, and Swedish crypto products, about 50% of year-to-date outflows occurred in January, with recent month-to-date outflows accounting for only about 26% of the year’s total divestment, according to CoinShares data.

--With assistance from Sam Potter.

©2024 Bloomberg L.P.