Apr 17, 2024

London’s Overlooked Outer Boroughs Help Drive Record Rent Rise

, Bloomberg News

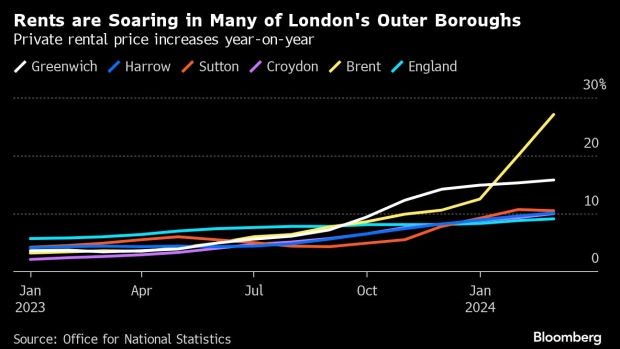

(Bloomberg) -- London’s long-overlooked outer boroughs helped to drive the pace of rental inflation in the capital to its highest level on record, compounding a cost-of-living crisis for tenants.

Private rents in London jumped 11.2% from a year ago in March, the Office for National Statistics said Wednesday. Places at the edge of the metropolis including Brent, Croydon, Greenwich, Harrow and Sutton suffered some of the biggest accelerations in recent months.

The figures mark a reversal from a year ago, when the rate of increase was faster across England as a whole than in many of London’s outer boroughs. It reflects both people moving back to the capital after the pandemic and the limits on space and affordability closer to the center of London.

The figures suggest that the advantage of finding cheaper living costs in many outer boroughs of the capital is fading as the supply of rental properties struggles to meet demand.

In Brent in north London, rents soared more than 27% in March, another sharp pick-up from the 20% jump seen the month before. Rental inflation has surged to double-digits in Croydon, Harrow and Sutton in 2024.

The average cost of renting in Brent is now just under £500 cheaper than well-heeled Islington. That’s smaller than the difference of almost £700 in December.

Rent increases in London continued to outstrip the rest of the country. UK-wide rents were up 9.2%, a record rise and up from 9% the month before, while Scotland also saw a strong 10.5% jump. The North East and South West of England enjoyed the smallest increases but still suffered a 6.1% and 6.9% rise, respectively.

Private renters “already spend a higher percentage of their monthly earnings on housing than those in all other forms of accommodation,”said Rebecca Florisson, principal analyst at the Work Foundation at Lancaster University. “With the average monthly private rent for England reaching £1,285 many low-paid workers will fear they are being priced out of their homes.”

The ONS also said that the average UK house price was £281,000 in February, up 0.4% compared to the previous month. Prices were down 0.2% year-on-year, the strongest annual performance since last June.

More timely indicators from Halifax and Nationwide Building Society have suggested that the house price recovery stalled in March. While mortgage rates are down on last summer’s highs, they remain stubbornly high as traders push back wagers on when the Bank of England will start cutting interest rates.

©2024 Bloomberg L.P.