Apr 19, 2024

Man Group Sees Clients Pull $1.6 Billion in the First Quarter

, Bloomberg News

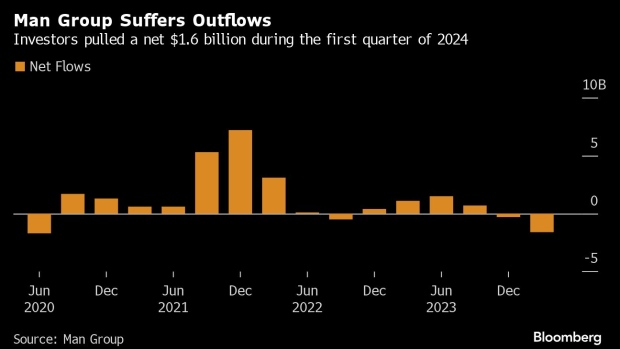

(Bloomberg) -- Man Group Plc reported $1.6 billion of outflows from its funds during the first three months of the year, the most in any quarter in almost four years.

The outflows were mainly from the hedge fund firm’s alternative money pools and exceeded company-compiled analyst estimates of $1.3 billion of inflows. Assets under management rose to a record $175.7 billion as the outflows were offset by $9.8 billion in performance gains, according to a statement Friday.

Clients pulled money for a second-consecutive quarter, signaling that the hedge fund industry is facing pressure from investors who are assessing their allocations. Investors took out a net $15.6 billion from hedge funds globally during the first two months of the year, according to data compiled by eVestment.

All four main computer-driven hedge funds run by Man Group made money during the quarter with the AHL Diversified fund soaring 12.1%, according to the statement.

©2024 Bloomberg L.P.