Apr 16, 2024

Massive Global Carry Trade Unwinding Hits the ‘Super Peso’

, Bloomberg News

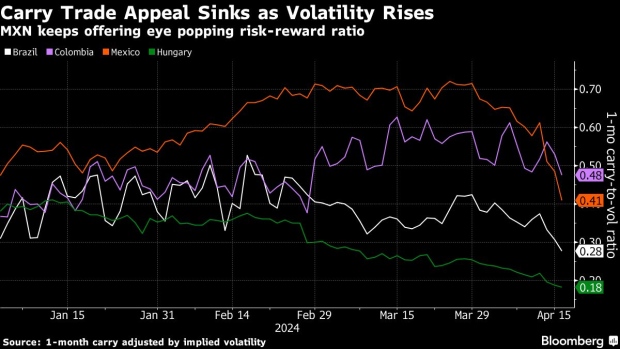

(Bloomberg) -- Carry traders are getting rid of their positions across emerging markets as funding costs increase and geopolitical risks boost implied volatility. Not even the Mexican peso, this year’s star currency, is being spared from the risk-off mood roiling global markets.

The “super peso,” the world’s best performing major currency since the end of 2016, is under pressure as traders ditch even their most profitable positions. The peso is among the worst performers on Tuesday, down as much as 1.7% as high-yield currencies are being dumped in favor of the dollar. The group includes the Brazilian real, the Colombian peso, the Polish zloty and the Hungarian forint.

Read More: Dollar Bulldozes Its Way Through EM Currencies Aided by Yuan

A combination of high interest rates, low volatility and political stability previously drew investors, wary of less liquid currencies, to the “super peso.” But recent spikes in volatility following stronger-than-expected inflation and retail sales prints in the US and a surge in the dollar are leading traders to revisit their positions.

“It is an environment of risk aversion due to an increase in volatility combined with an expectation of a lower rate differential,” said Miguel Iturribarria, a strategist at BBVA Mexico. BBVA’s forecast is for the peso to hit 17.40 per dollar in the coming two months and end the year at 18.20 per dollar, from a current 17.

Strong increases in implied volatility are weighing on the currency, as traders evaluate the attractiveness of carry trades, where they borrow in lower-yielding currencies to buy those that offer higher yields.

The move in the Mexican peso was so severe — implied one-month volatility spiked to 13.4% on Tuesday, up from 7.4% at the end of March — that its Colombian counterpart became the best option for carry trades in Latin America.

Bullish positioning on the peso has exacerbated the currency’s downward trend. CME Group’s futures exchange data in recent weeks showed an increase in peso bets, with positions from leveraged funds reaching 57,711 contracts in the week through April 9, the highest since March 2023.

While longer-term positives are still expected to outweigh the negatives and the Mexican currency cushioned by the country’s close ties with the US and the impact of near-shoring, the currency is expected to suffer until more of those positions have been unwound.

“We’ll see vol come back down and with that we’ll see USD/MXN retest the recent lows in the coming weeks,” said Christian Lawrence, a strategist with Rabobank in New York.

--With assistance from Michael O'Boyle and Maria Elena Vizcaino.

©2024 Bloomberg L.P.