Apr 26, 2024

Nigeria Bank Stocks Dip as Investors Flee Dilution on New Rules

, Bloomberg News

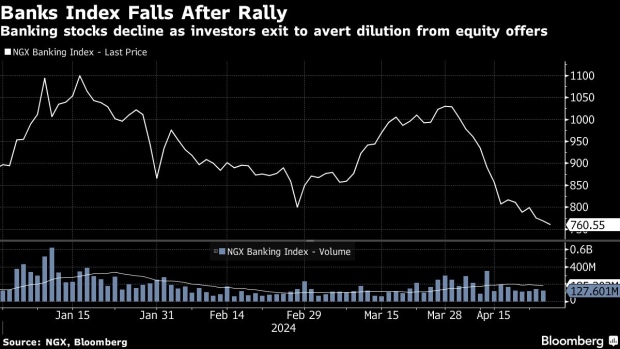

(Bloomberg) -- Nigerian banking stocks have lost more than a quarter of their value since the central bank announced a new minimum capital threshold that will force them to issue new shares.

The NGX Banking 10 Index, a gauge tracking the nation’s biggest lenders, is down 26% this month, heading for its biggest monthly decline in 10 years and bringing its yearly loss to 15%. That compares with a 31% gain so far in 2024 on the all-share index of the Lagos-based bourse, the second best performance among stock markets globally, according to data compiled by Bloomberg.

The selloff in banks comes after a March 28 announcement by the Central Bank of Nigeria that it was increasing lenders’ minimum capital 10-fold to 500 billion naira ($395 million), with a restrictive definition of capital that will force them to issue new shares.

“A large number of shares have to come to the market, diluting existing shares,” Samuel Sule, Renaissance Capital Africa’s chief executive officer, said by phone. “It is making investors reallocate” to fixed income, other sectors or wait to buy banks shares that will be put on offer, he said.

The central bank has said that it will recognize only paid-in capital and share premium when computing minimum capital, discounting billions in retained earnings accumulated by the lenders over the years. That will compel banks in the West African nation to raise at least 2.82 trillion naira ($2 billion) to meet minimum capital requirements over the next 24 months. Banks have until the end of this month to present their capital-raising plans to the central bank.

Some banks have already announced. GTBank will raise $750 million in fresh capital that will include both equity and debt. Standard Bank’s Nigeria unit, Stanbic IBTC, plans to seek $427 million in debt and equity, while Fidelity Bank plans to raise 150 billion naira through a public offer this quarter.

In anticipation that the market was going to ‘reprice’ after this year’s rally and ahead of new share offers, Damilola Olupona, senior research analyst at Lagos-based StoneX Financial Nigeria Ltd., told clients to exit bank shares, he said by phone from Lagos, the nation’s commercial capital.

“It makes sense to sell off and be on the sideline or wait for the next catalyst to invest again,” he said.

Access Holdings Plc, the industry’s biggest bank by assets, has shed about 35% of its value since the announcement. Zenith Bank Plc, the biggest lender by market value, is down 17%.

©2024 Bloomberg L.P.