Apr 18, 2024

Rupiah Bonds Rally Most in Three Months as Dip Buyers Emerge

, Bloomberg News

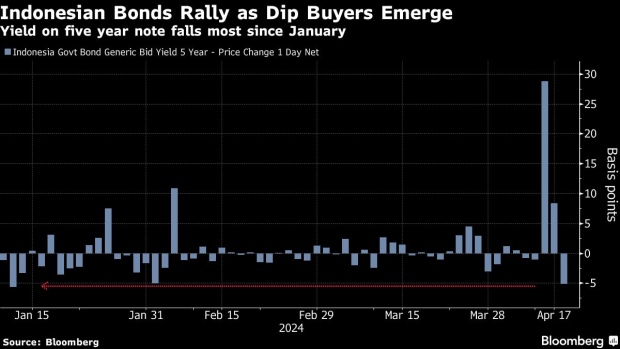

(Bloomberg) -- Rupiah notes rallied the most in about three months as investors rushed to buy after the selloff earlier this week.

The yield on five-year bonds slid five basis points to 6.89% Thursday, the most since Jan. 11, while benchmark 10-year yields fell three basis points to 6.94%. Bonds of Asian peers South Korea, India and Singapore also gained, tracking an advance in US treasuries.

A gauge of Indonesian debt fell 1% this week amid a broad risk-off sentiment in the region as traders recalibrate bets on Federal Reserve interest-rate rate cut expectations. That pushed up the yield on the benchmark bond to almost 7% Wednesday.

“The 10-year yield is very attractive at around 7% as long as no bad issue on domestic side,” said Myrdal Gunarto, an analyst at Maybank in Jakarta. He sees investors ‘buying the dip’ in Indonesian government bonds going forward due to their relative attractiveness.

©2024 Bloomberg L.P.