Apr 21, 2024

S&P 500 will get its mojo back from strong earnings

, Bloomberg News

How the S&P 500 typically reacts to geopolitical crises

Robust earnings from Corporate America will pull the S&P 500 Index out of its latest morass, despite rising concerns about a significant jump in bond yields, according to Bloomberg’s latest Markets Live Pulse survey.

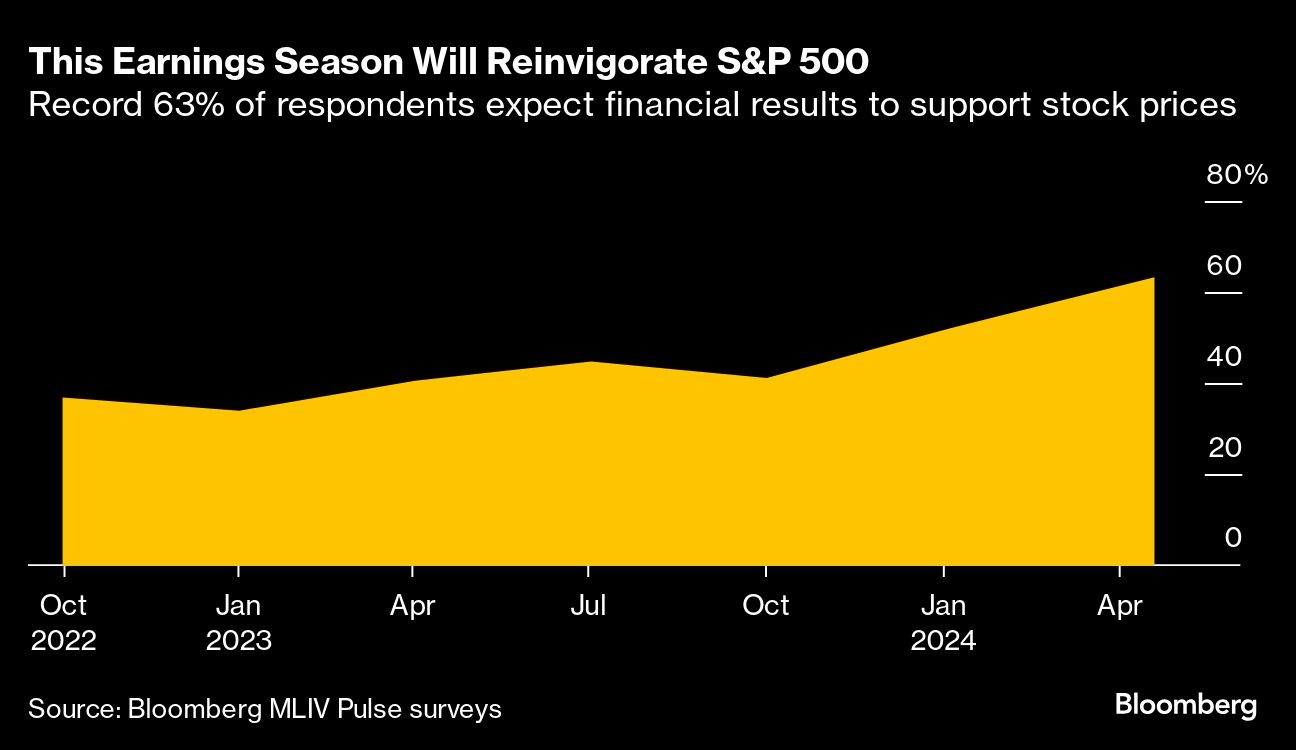

With reporting season kicking into high gear this week featuring results from Big Tech giants such as Microsoft Corp., Meta Platforms Inc. and Alphabet Inc., nearly two-thirds of 409 respondents said they expect earnings to give the U.S. equity benchmark a boost. That’s the highest vote of confidence for corporate profits since the poll began asking the question in October 2022.

“There are simply no signs of a slowdown in corporate earnings,” Torsten Slok, chief economist at Apollo Global Management, said in a note this morning. “The economy continues to power ahead fueled by easy financial conditions.”

Rising geopolitical risk doesn’t seem to be a major fear, despite tensions escalating in the Middle East. One reason could be that historically, stocks have held up following similar stress events. An analysis by multi-asset strategists at HSBC Holdings Plc showed that over the last 25 years U.S. equities have posted gains 70 per cent of the time on average following significant geopolitical events.

Indeed, the S&P 500 has rallied since this conflict started on Oct. 7, so traders and investors seem to have absorbed that uncertainty — at least for now.

“If anything, the aftermath of such events presents a buying opportunity,” strategists led by Max Kettner wrote in a note. “Beyond geopolitics, fundamentals are still supportive, with growth expectations still moving higher.”

Regardless, companies are facing enormous pressure to deliver strong earnings this season. Without that, survey respondents expect U.S. stocks to be trounced by soaring bond yields. Almost half consider yields on 10-year Treasuries climbing above five per cent to be a major risk, bigger than rising oil prices or failing to deliver on artificial intelligence promises.

“When we remove the prop of accommodative monetary policy, that puts more of the burden on earnings than we think,” said Julian Emanuel, chief equity and quantitative strategist at Evercore ISI.

The focus on earnings is well-timed for the S&P 500, which has struggled since setting a record on March 28 as the U.S. Federal Reserve signals it’s in no rush to cut interest rates after a series of hotter-than-expected inflation prints. The benchmark is trading at a two-month low and is down 5.5 per cent from its all time high.

“The first quarter earnings season could give a nice support for U.S. equities, especially with this selloff we've seen over the past month," said Nicole Inui, head of U.S. and LatAm Equity Strategy at HSBC.

History indicates that a rally may be in store. Since 1999, the S&P 500 has risen 67 per cent of the time between between the days JPMorgan Chase & Co. and Walmart Inc. report results, the unofficial beginning and end of earnings season, according to data compiled by Bloomberg.

However, the size of the rally in any given reporting period depends on how much exposure investors already have to equities, Deutsche Bank AG strategists led by Parag Thatte said in a note to clients. Allocation is already high this time around, after the record-breaking advance in the first quarter. So Thatte’s team doesn’t expect big gains.

Results from U.S. technology behemoths will take center stage this week, bringing the market’s focus to the frenzy surrounding AI.

The attention appears to be shifting away from AI poster child Nvidia Corp. after the stock’s whopping 54 per cent leap this year. Half of the MLIV survey’s respondents said the best way to increase AI exposure is through secondary and tertiary plays, such as power grids that will benefit from AI’s massive energy demands. Meanwhile, less than a fifth of participants saw an opportunity in buying any dip in Nvidia shares. The stock lost 10 per cent of its value on Friday.

The bottom line is the upcoming earnings reports from America’s corporate giants offer the U.S. stock market an opportunity to flip the script after three straight losing weeks by the S&P 500, the longest streak since September. But the results have to warrant changing the recent narrative.

“The earnings season is being widely overlooked as the market focuses on rates and other uncertainties,” said Florian Ielpo, the head of macro research at Lombard Odier Asset Management. “The start to the season has been strong.”

Methodology

The MLIV Pulse survey was conducted among Bloomberg News readers on the terminal and online April 15-19 by Bloomberg’s Markets Live team, which also runs the MLIV blog.