Apr 9, 2019

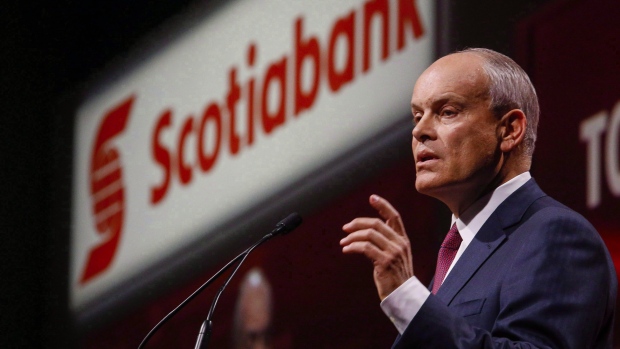

Scotiabank CEO dismisses U.S. hedge funds shorting Canadian banks

, Bloomberg News

Shorting Canadian banks has long made for a poor bet by U.S. hedge funds, and this time will be no different, according to Bank of Nova Scotia Chief Executive Officer Brian Porter.

“U.S. hedge funds, from time to time, have appeared in this country over the last 10 years with the same hypothesis of shorting Canadian banks, and it hasn’t worked well for them,” he said Tuesday at the company’s annual meeting in Toronto in response to an investor’s question.

While Porter said “there’s clearly a concern out there about the state of the Canadian housing market,” no hedge funds have talked to Scotiabank about the company’s assets or balance sheet. Canadian mortgages are the largest asset class on Scotiabank’s books, at about $205 billion, with 42 per cent of those home loans insured, and the loan-to-value ratio on the balance at about 54 per cent.

“So we believe there’s a lot of buffer in there for any significant downturn,” he said. The bank stress-tests its loans daily against “very harsh metrics” -- including a 600-basis point increase in interest rates and huge jump in unemployment -- to make sure it would remain profitable and be able to pay a dividend, Porter added. “There are always going to be those that take an opposing view. We’ll prove them wrong in the long term.”