Europe’s Biggest Smart City Rises in Greece

Along the coast of Athens, a vast complex of homes, hotels, marinas and more is taking shape

Latest Videos

The information you requested is not available at this time, please check back again soon.

Along the coast of Athens, a vast complex of homes, hotels, marinas and more is taking shape

Tenants in New York City’s 1 million rent-stabilized apartments are on track to face the third year in a row of rent increases as renters and landlords grapple with rising costs.

A group backed by Silicon Valley investors aiming to build a new city in California has collected enough support from residents to place a key zoning-change measure on the upcoming ballot.

Ireland has become one of only two European Union states to have no women leading any of its listed companies, in a setback for a country that has become known for achieving rapid social change in recent decades.

An unprecedented contest is underway in Mexico over the future of one of the top beneficiaries of the factory boom south of the US border.

Jun 3, 2016

While some still only cautiously refer to Canada’s hottest housing markets as being in a “B-Word”, Ryan Lewenza says “bubble” very clearly describes the trend in Vancouver and Toronto real estate.

“I would define it as a bubble,” the Turner Investments portfolio manager said on BNN Friday morning. “When you look at the year-over-year increases relative to rents, relative to underlying fundamentals – we’re at stratospheric valuations, if you will. So I would say we’re in a bubble.”

Sherry Cooper, chief economist with Dominion Lending Centres, also told BNN she was “getting very worried… because the price acceleration is increasing.”

“These things generally don’t end well,” Cooper said.

Home sales in the Greater Toronto Area last month set a new record for the month of May, according to data released Friday by the Toronto Real Estate Board. The dramatic growth came despite a dearth of new inventory that helped drive prices higher.

12,870 homes were sold across the region, marking a 10.6 per cent increase compared to May 2015. New listings, meanwhile, fell 6.4 per cent from one year earlier to 17,412.

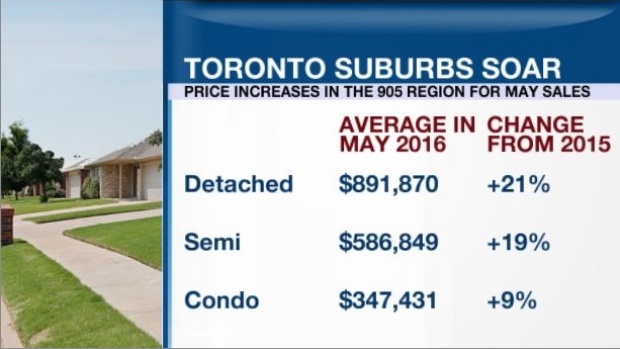

The average selling price in the GTA surged 15.7 per cent from a year ago, reaching $751,908. In the city centre – defined by the 416 area code – average prices grew by more than $64,000 since May 2015 to reach $782,051; while price growth in the surrounding 905 region was nearly double that of downtown, increasing more than $123,000 from last year to reach $734,924.

"While the record number of home sales through the first five months of 2016 is not necessarily surprising, it does sometimes mask the larger story in the GTA: the shortage of listings, which has resulted in strong upward pressure on home prices," said TREB President Mark McLean in a statement.

The record-setting sales performance in Canada's largest city comes hot on the heels of similarly scorching activity in Vancouver. The Real Estate Board of Greater Vancouver said on Thursday that sales in Metro Vancouver rose 17.6 per cent last month, while the benchmark selling price surged 29.7 per cent.

Unlike the Toronto market, new listings in Vancouver grew by nearly 12 per cent but seemingly insatiable demand continued pushing prices to new peaks. Detached homes in the west coast city sold for an average price of $1,513,800 in May, representing a 37 per cent increase from a year earlier.

“Two past episodes in Canada that most would associate with the B-word – Calgary in 2006 and Toronto in the late-80s – saw price growth push through 40 per cent [year-over-year],” BMO Financial Group senior economist Robert Kavcic wrote in a note published Friday morning. “We know for sure both of those episodes ended poorly.”

Calls have been increasing for the government to intervene in some fashion to cool the rapid pace of home price growth in Canada, with the CEOs of two major banks and the Organisation for Economic Co-operation and Development calling for more action from Ottawa this week. Higher down payment requirements that took effect in February have made virtually no difference and the heads of the Bank of Nova Scotia and National Bank have both called for minimum down payments to be increased again.

Top money managers on Bay Street are split on the idea of additional government intervention, according to a BNN survey, but among those that favour more action the clear preference is to focus on foreign buyers. Lewenza says both higher down payments and restrictions on foreign buyers are viable options.

“I think we probably have to increase the down payments and maybe a higher tax on foreign buyers coming in,” he said. “But I think something does need to be done and it probably needs to be done from the government level.”

Among the respondents to the BNN survey who advised against further government intervention, several expressed concern over the potential for “unintended consequences” resulting from more regulatory action. Cooper expressed a similar concern.

“If the government were to take aggressive action we could end up with a bubble bursting and a collapse,” she said.