Jun 8, 2016

Suncor gives itself extra M&A firepower with $2.5B share sale

Suncor Energy could be on the verge of expanding its already dominant Alberta oil sands position.

Late Tuesday, the Calgary-based company announced plans to sell up to $2.5-billion in new shares. Already among the largest bought deals in Canadian history, Suncor could increase that amount to $2.9-billion if investors show significant levels of interest.

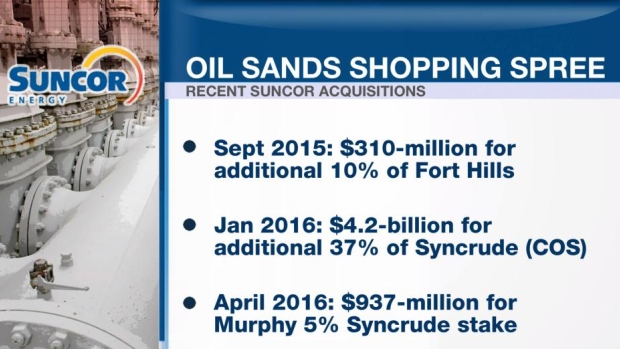

While the company’s release announcing the bought deal mentions several different ways Suncor will spend the money – from paying off its purchase of Murphy Oil’s stake in Syncrude, to reducing its debt load – but there is one use in particular the release mentions that has attracted the most analyst attention: “opportunistic growth transactions that Suncor may identify in the future.”

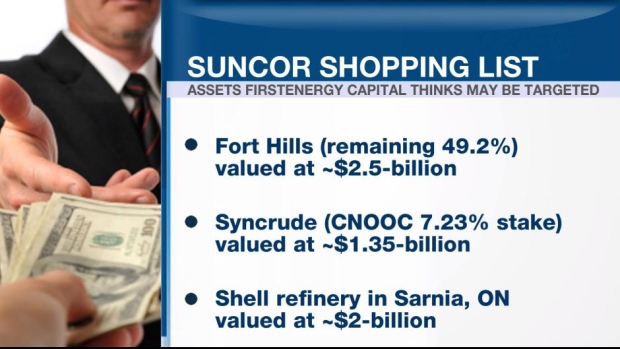

The future may not be far off in the minds of analysts from Raymond James and FirstEnergy Capital. Suncor is “most likely” to acquire the rest of the Fort Hills oil sands mine from its partners Total and Teck Resources, according to Michael Dunn of FirstEnergy. After buying 10 per cent of the $15-billion project from France’s Total for $310-million last fall, Suncor owns 50.8 per cent of Fort Hills and Dunn’s math says it will cost the company roughly $2.5-billion to buy Total’s remaining 29.2 per cent stake and Teck’s 20 per cent stake to assume full ownership.

David Taylor, chief investment officer at Taylor Asset Management, told BNN on Wednesday that Suncor may think bigger -- potentially targeting rival oil sands players such as Cenovus Energy or MEG Energy for acquisition.

“I do think MEG is far more concentrated [and] has certainly brownfield where you can really quite easily increase production from 80,000 to 120,000 barrels a day and it is there, it is just there for the taking,” Taylor said. “MEG would do it tomorrow if their balance sheet was stronger and I think Suncor sees that.”

“[MEG] has giant debt issues but not in the hands of Suncor… in the hands of Suncor it is just a beautiful leverage play to rising oil prices,” Taylor said. “They have also just taken the chairmanship away from the CEO so there is a bit of a shareholder revolt here so maybe Suncor senses that some of the shareholders are unhappy with what has gone on at MEG.”

MEG’s flagship Christina Lake asset south of Fort McMurray is widely considered among the lowest-cost production in the oil sands region, although the company has roughly $4.7-billion in debt compared to a market valuation of roughly $1.7-billion. The stock has lost more than two thirds of its value over the past 12 months; but on October 5th 2015 – the day Suncor launched its $4.2-billion bid to buy Canadian Oil Sands – MEG shares surged more than 22 per cent as investors wagered MEG would be next to find itself in Suncor’s crosshairs.

Taylor said he expects the Suncor bought deal to do “exceptionally well” and will be “significantly oversubscribed” to such an extent that other Canadian producers such as Encana Corp. and Paramount Resources will likely announce their own equity deals in the near future. However, he cautioned such an issue “is not for everyone.”

“A company like Penn West would have to dilute their [share] count by 50 per cent and nobody would participate in something like that and if they did it would have to be at a significantly lower price so a deal like this is not for everybody, not for every company,” Taylor said.

“There will be a significant number of bankruptcies still.”