Apr 16, 2024

UK Appoints Jessica Pulay as Head of Debt Management Office

, Bloomberg News

(Bloomberg) -- The UK government selected Jessica Pulay to succeed Robert Stheeman as the head of the nation’s Debt Management Office as it embarks on one of its biggest annual borrowing sprees on record.

Pulay is currently the co-head of policy and markets, and will take on the new role at the end of June, the Treasury said on Tuesday. Stheeman, who’s retiring after over two decades as chief executive, will remain in place for the transition period.

Prior to joining the debt office, Pulay spent 16 years at the European Bank for Reconstruction and Development in London. Earlier in her career, she was an executive director at Morgan Stanley and Goldman Sachs Group Inc, and a managing director at Deutsche Bank AG. She will become the agency’s first female chief executive officer.

“She brings with her over three decades worth of relevant experience, is highly regarded in the market, and the appointment provides strong continuity to a critical government function as the DMO looks to the future,” Chancellor of the Exchequer Jeremy Hunt said in the statement.

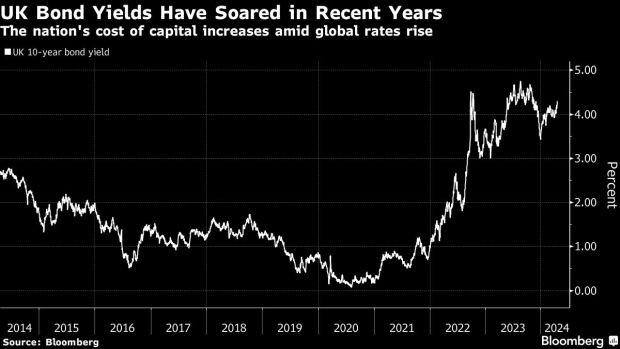

Her appointment comes at a challenging time for the DMO, which has unveiled a plan to issue the second-largest annual amount of bonds in the 2024-25 fiscal year. The new supply adds to debt the Bank of England is also offloading from its balance sheet, potentially leaving investors with a record amount of bonds to absorb.

It’s “definitely a positive that she has experience on both sides,” said Gordon Shannon, a portfolio manager at Twentyfour Asset Management LLP in London. “Government supply is going to be a much more important driver over the next decade.”

Pulay said in a statement she looked forward to continue working with financial market participants and the DMO’s wider stakeholder group, whose support “will ensure that the UK’s financing program will continue to be smoothly and effectively delivered in the years ahead.”

The new chief will also have to navigate a sea-change in demand for government bonds, as defined-benefit pension funds pull back from their role as key buyers of long-dated and inflation-linked debt.

The DMO acts as an intermediary between the government and markets, picking bond maturities to sell and making sure auctions run smoothly.

Stheeman has overseen the office for the bulk of its history after it was created in 1998, when responsibility for government debt issuance was transferred away from the newly-independent BOE. In a recent interview with Bloomberg News, Stheeman said the challenge facing his successor is how to ensure the liquidity and stability of the market.

(Updates with additional quotes from paragraph five.)

©2024 Bloomberg L.P.