Apr 10, 2024

Uruguay’s Central Bank Pivots Back to Easing With Half-Point Cut

, Bloomberg News

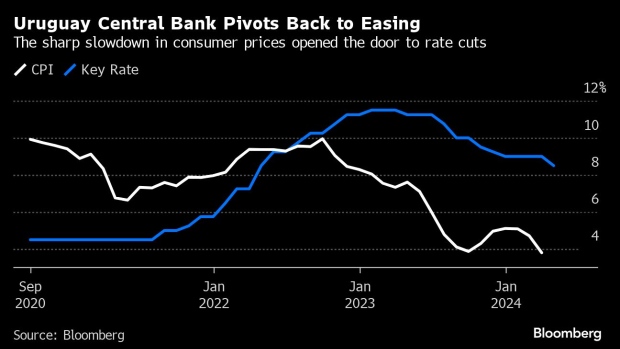

(Bloomberg) -- Uruguay’s central bank resumed its easing cycle with a half-point cut to its benchmark interest rate after inflation rose at the slowest pace since 2005.

The central bank said it lowered the key rate by 50 basis points to 8.50% following a pause in February thanks to a gradual drop in inflation expectations and a sustained slowdown in consumer price increases that’ve stayed within the 3% to 6% target. The move on Wednesday marked the central bank’s biggest since a half-point reduction last October.

Monetary policy going forward will seek “to keep inflation in the center of the target range” and achieve the convergence of inflation expectations with the central bank’s 24-month policy horizon, policymakers said in a statement after their decision.

Read more: Uruguay Central Bank Chief Sees Room for Lower Interest Rates

Receding inflation across Latin America has allowed central banks to lower interest rates. Mexico was the last major inflation targeting central bank in the region to join the rate cutting club in late March.

Uruguay, long a high inflation outlier in Latin America, has logged 10 consecutive months of inflation within the target range. Inflation slowed to 3.8% in March, the smallest gain since August 2005.

Inflation expectations are slowly falling but remain at or near the target ceiling. The most recent survey of analysts by the central bank put inflation at 5.98% at the end of the year, while the 24-month outlook was steady at 6%.

©2024 Bloomberg L.P.