Apr 25, 2024

US GDP Report Set to Highlight Immigration-Driven Economic Boom

, Bloomberg News

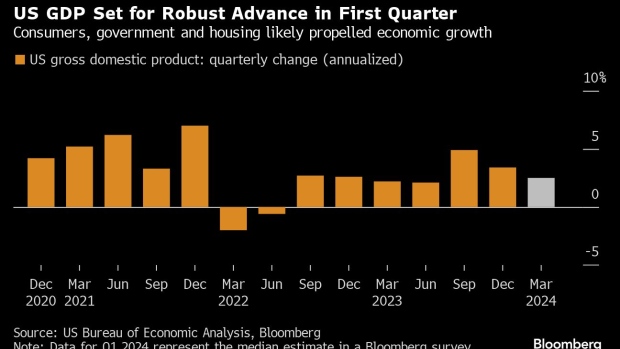

(Bloomberg) -- Initial data on US gross domestic product for the first quarter of 2024 is set to confirm an ongoing economic boom amid a tailwind from surging immigration.

The figures, to be published Thursday by the Bureau of Economic Analysis, will probably show GDP rose at a 2.5% annualized rate over the first three months of the year, according to the median estimate in a Bloomberg survey. Consumer spending is seen advancing 3%.

While both estimates would mark a step down from growth rates in the previous quarter, they would lead to an acceleration in GDP growth on a four-quarter basis, to the fastest pace in two years. Economists have generally been revising their forecasts higher after a recent Congressional Budget Office report estimated more immigration than previously thought.

Here’s what to watch for in key components of the report:

Consumer Spending

Personal consumption expenditures account for about two-thirds of GDP, and they probably continued to propel growth in the first quarter. Monthly data for January and February indicated a robust advance in services spending in particular, while goods spending edged lower.

“Consumers picked up spending on retail in March, while spending on food services — the primary proxy for services in the retail-sales report — remained solid,” Bloomberg economists led by Anna Wong wrote in a preview of the numbers. “Strong payrolls, driven by increased labor supply, have supported aggregate income growth and, in turn, consumption.”

Investment

Business investment probably rose more modestly in the first quarter. Monthly figures on durable goods orders published Wednesday showed nondefense capital goods shipments fell by 1.5% in March on an annualized basis, pointing to a likely reduction in equipment outlays in the GDP numbers.

“Weather and aircraft orders have led to some volatility in recent data, but overall, we expect business investment to remain a drag, weighed on by higher interest rates,” Citi economists Alice Zheng and Andrew Hollenhorst said Wednesday in a note to clients.

Residential investment, on the other hand, may have contributed the most to GDP growth since 2020, according to Goldman Sachs economist Spencer Hill. Mortgage rates were around a half-point lower on average in the first three months of the year than in the final quarter of 2023 — which helped boost sales of new and existing homes — though rates have risen again in recent weeks.

Government Spending

Economists also see government spending as an important contributor to GDP growth in the first quarter. That’s thanks in part to ongoing catch-up at the state and local level, where spending was curtailed during the pandemic.

The rebound is evident in monthly employment data: Local government headcount rose by 3.4% annualized in the first quarter, the most since 2021, while state government payrolls advanced by a similar amount.

“We expect government spending will be the second largest contributor to growth, as state and local spending continues to close its post-Covid spending gap,” Michael Reid, US Economist at RBC Capital Markets, said Monday in a note.

(Corrects title of Michael Reid to US Economist from chief US economist in 12th paragraph)

©2024 Bloomberg L.P.