Apr 26, 2024

Yen Traders See Risk of Intervention at Highest Since Late 2022

, Bloomberg News

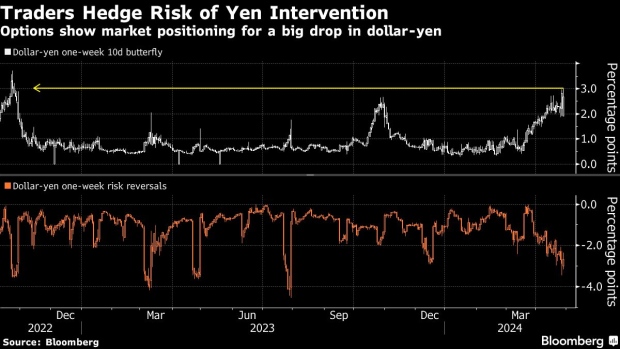

(Bloomberg) -- Traders are preparing for Japanese authorities to step in and prop up the yen, with demand for derivatives that benefit from volatility at the highest since officials last intervened in 2022.

Appetite for options that pay out on a sizable move in the Japanese currency in either direction is at the highest level since October 2022. So-called risk reversals, a barometer of market positioning and sentiment, show this is down to hedging against a sharp rally.

The yen dropped as much as 0.8% on Friday to 156.82 per dollar, a fresh 34-year low, before briefly erasing losses in volatile trading in the London morning. The Bank of Japan earlier kept interest rates unchanged, but policymakers have repeatedly warned against a quick drop and intervention risk based on past remarks from Masato Kanda, Japan’s top currency official, is inching closer to the danger zone.

Selling the yen in the spot market and using part of the profits to fund a long position through options has been a common strategy among interbank and leveraged desks this year, according to FX traders familiar with the transactions who asked not to be identified because they aren’t authorized to speak publicly.

The yen is down 10% since January and a steep acceleration of the move could lead Japanese authorities to step in. Kanda said in February that a 10-yen move over one month against the dollar is considered rapid.

The release of the Federal Reserve’s preferred US inflation gauge later on Friday is a potential trigger for steep declines, as well as next week’s central bank meeting and jobs report.

One-week volatility in dollar-yen is up a fourth day and is heading for its strongest close in four months, even as the BOJ-meeting risk is priced out. This shows that intervention risk is keeping demand for long-volatility exposure intact.

- NOTE: Vassilis Karamanis is an FX and rates strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice

--With assistance from Masaki Kondo.

©2024 Bloomberg L.P.