Apr 17, 2024

Yuan Funding Costs Climb in Hong Kong, Pressuring Bearish Bets

, Bloomberg News

(Bloomberg) -- Signs of a cash squeeze are starting to emerge in the yuan’s largest offshore trading center, a move that dents the appeal of bearish wagers on China’s managed currency.

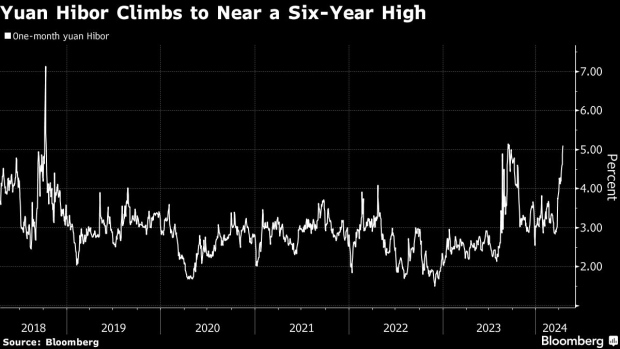

A key gauge measuring the cost for banks to borrow the yuan from each other in Hong Kong — known as Hibor — rose to approach the highest since 2018. That means it’s getting costlier for traders to seek financing in yuan in the money market and buy the dollar, a strategy that helped to push the Chinese currency to a five-month low this week.

While it’s unclear whether Chinese authorities are behind the funding squeeze this time around, in the past they have targeted a draining of offshore liquidity to punish traders speculating against the yuan. The currency has come under renewed pressure of late on the back of a resurgent dollar and souring sentiment toward China’s economy.

The People’s Bank of China moved to allow for some moderate yuan weakness on Tuesday, as it unexpectedly weakened its daily reference rate for the currency.

“Widening yield differentials between US and China underpin yuan softness,” said Christopher Wong, a currency strategist at Oversea-Chinese Banking Corp. The officials may be behind the jump in Hibor as it could dampen short bets on the yuan, he added.

One-month Hibor rose 22 basis points to 5.105%, while the overnight tenor increased eight basis points.

©2024 Bloomberg L.P.