Dec 7, 2017

Bitcoin could hit 'a heck of an air pocket': Money manager

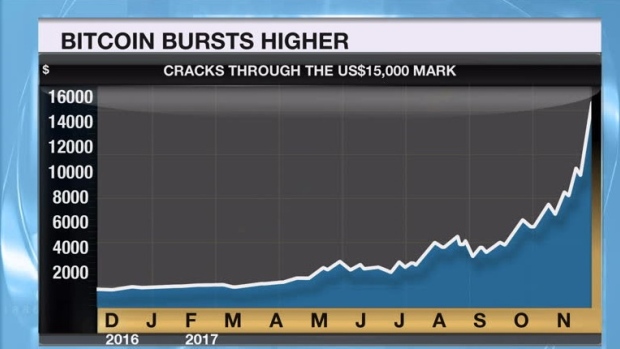

Bitcoin broke through the US$15,000 per coin level early Thursday, the latest milestone in a bull run that has seen the cryptocurrency post a 1,500-per-cent gain over the course of 2017.

Speculators have piled into bitcoin in spite of repeated warnings from high-profile finance experts - including JPMorgan Chief Executive Officer Jamie Dimon, who went so far as to call the cryptocurrency a fraud.

Despite the meteoric rise in bitcoin, there may be clouds forming on the horizon. Both the CME and the CBOE are launching bitcoin futures trading, which will make it easier for skeptical investors to bet against the cryptocurrency. The launch of futures contracts will also make it more accessible for smaller, less sophisticated investors to make a bullish bet.

TMX, the operator of the Toronto Stock Exchange and the Montreal Exchange, which handles options, has said it is keeping a close eye on demand for bitcoin trading platforms, but does not yet have any plans to get into the space.

While the launch of options trading in the U.S. could appeal to mom and pop investors looking to get a piece of the bitcoin pie, there are some alarm bells ringing on Bay Street.

In an interview on BNN, Greg Newman, a senior wealth advisor at Scotia Wealth Management, said he thinks there will be turbulence once the CBOE rolls out options trading on Sunday.

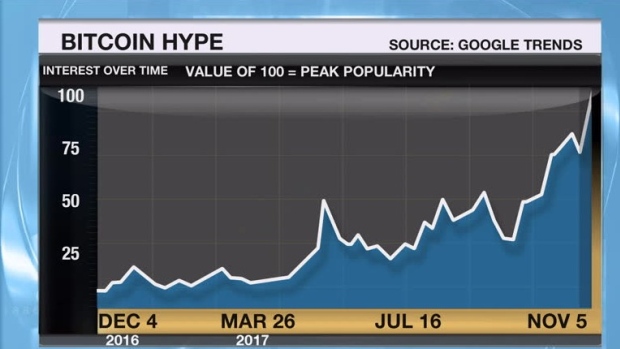

“I think a lot of the money that’s in there is gambling. When you look at this chart, I would be very wary of what’s going to come Sunday,” he said. “Anything could happen, I could be wrong, but I would suggest that there might be a heck of an air pocket.”

While Newman said he doesn’t think bitcoin is worthless, he compared the euphoria surrounding the value of the cryptocurrency to the Tulip Mania that gripped Europe in the late 1630s.

“This is like a flavour of the day, this is one of these things that we’re all seized with right now. And this will pass. Bitcoin is worth something; the question is, what is it worth?” he said.

“Tulip bulbs were worth something, and they went to some outrageous price, like the prices of homes 300 years ago. They were worth something, but were they worth that?”

Such is the interest in bitcoin that no less than former U.S. Federal Reserve Chair Alan Greenspan felt the need to weigh in. Speaking on CNBC, he didn’t rule out the possibility that bitcoin might be worthless, but said that hasn’t stopped human nature from ascribing value to objects of little worth.

"Humans buy all sorts of things that aren't worth anything," he said. "People gamble in casinos when the odds are against them. It has never stopped anybody."