Feb 27, 2018

BNN's Daily Chase: Bank earnings continue, Morneau set to deliver budget

By Noah Zivitz

Earnings season resumed this morning with Bank of Nova Scotia first out of the gate. It matched last week’s performances by RBC and CIBC with a profit beat and dividend boost. Scotia’s international and Canadian banking units posted double-digit gains, with the domestic division’s net income topping one billion dollars. BMO, meanwhile, topped profit estimates – thanks in no small part to 30 per cent growth in its U.S. P&C division, and left its dividend unchanged.

BUDGET DAY

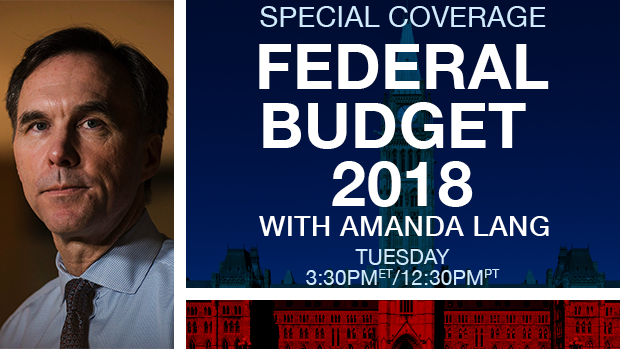

After a firestorm over small business tax changes and perceived ethical controversies took over the narrative in the second half of last year, today Bill Morneau gets his best chance to take back control of the message. The finance minister will table his third budget this afternoon. Notwithstanding NAFTA uncertainty and Donald Trump’s drive to roll out the welcome mat for businesses, most pundits are anticipating a stay-the-course strategy from the Liberals.

The most important issue as far as Bay Street is concerned is whether Morneau will deliver a roadmap to balanced budgets. Who knows if he’ll deliver. What we are expecting is actual policy on bolstering gender equality. And after Eric Hoskins resigned yesterday as Ontario health minister, there are reports he could be tapped by the feds today to lead a national pharmacare program.

Our special coverage starts at 3:30 p.m. ET, and we’ll have unmatched reaction from leaders of industry and top economic thinkers with the likes of Pimco’s Ed Devlin, former B.C. Finance Minister Carole Taylor, Bruce Croxon and Bank of Nova Scotia Chief Economist Jean-Francois Perrault (who was previously a deputy minister in the finance department). And we'll round it out with Morneau himself. We’re expecting to speak with him at 5:50 p.m. ET.

TIMS REPORTEDLY HIT BY VIRUS

The already-fractious relationship between Tim Hortons and its franchisees is reportedly suffering another setback. The Globe and Mail is reporting hundreds of stores across the country have been hit by a virus that knocked out cash registers and point-of-sale terminals, prompting an angry letter from the Great White North Association. This brings us back to same question of whether tension behind the scenes risks spilling over to the frontlines.

DOW ON A TEAR

After surging almost 400 points yesterday, the Dow Jones Industrial Average is on the cusp of fully recovering from the big hole it dug itself into earlier this month. Futures are pointing to a muted open as investors wait to take their cues from Jerome Powell, who faces his first round of Congressional testimony as U.S. Fed chair today at 10:00 a.m. ET.

COMCAST ELBOWS ITS WAY IN ON SKY

Rupert Murdoch's 21st Century Fox has a takeover fight on its hands after Comcast announced a potential competing bid for Sky Plc. Comcast presented a “possible offer” of 12.50 British Pounds for each Sky share, raising the stakes from the 10.75 GBP that Fox agreed to pay in December for the Sky shares it doesn't already own. It's a Battle Royale, with Walt Disney also having a stake in all of this after it agreed to buy Sky and other assets from Fox for more than US$50 billion last year. It's a complicated dance that appears to be all about defending turf. We'll try to distill it.

OTHER NOTABLE STORIES:

-Pieridae Energy is taking another step toward achieving its east coast LNG ambitions, announcing today it has tapped Morgan Stanley and SocGen to help it raise US$10 billion.

-Aurora Cannabis says it has struck a deal to supply medical cannabis to Shoppers Drug Mart.

-Canadian medical cannabis producer Cronos Group will start trading on the Nasdaq today

NOTABLE RELEASES/EVENTS

-Notable earnings: Bank of Nova Scotia, Bank of Montreal, Imax, Macy's

-Notable data: U.S. durable goods orders, S&P/Case Shiller U.S. home price index, U.S. consumer confidence

-10:00 a.m. ET: U.S. Federal Reserve Chair Jerome Powell testifies before U.S. House Financial Services Committee

-4:00 p.m. ET: Finance Minister Bill Morneau tables federal budget

-BMO Capital Markets' global metals and mining conference continues in Florida (to Feb. 28)

-Seventh round of NAFTA negotiations continues in Mexico City (to March 5)

Every morning BNN's Managing Editor Noah Zivitz writes a ‘chase note’ to BNN's editorial staff listing the stories and events that will be in the spotlight that day. Have it delivered to your inbox before the trading day begins by heading to www.bnn.ca/subscribe.