Mar 18, 2024

BOJ to End Yield Curve Control, ETF Buying Tuesday, Nikkei Says

, Bloomberg News

(Bloomberg) -- The Bank of Japan is poised to end on Tuesday its yield curve control policy as well as purchases of riskier assets such as exchange-traded funds, Nikkei reported, without saying where it got the information.

The Japanese newspaper said the BOJ will also end its negative short-term policy rate stance the same day. It will continue buying some Japanese government bonds in order to keep bond yields from spiking, though will scrap its framework for tamping down rates known as YCC, the Nikkei said.

Governor Kazuo Ueda and his colleagues are set to announce their new policy settings at the end of a two-day meeting Tuesday. Japan’s central bank has maintained the YCC policy framework since 2016 — sticking with it even as inflation spiked in recent years. And Japan’s monetary policymakers have been purchasing exchange-traded funds and real estate investment trusts for an even longer period.

A leading proposal for this week’s meeting is to lift the short-term benchmark rate to between zero and 0.1%, the Nikkei said. Meantime, the BOJ plans to remove the 1% reference cap for 10-year government bond yields, the newspaper said.

Some 90% of BOJ watchers see the chance of authorities ending the 0.1% short-term negative rate when policymakers meet this week, while a number of news outlets have reported a policy shift is likely.

Those views were bolstered after the nation’s largest union group announced on Friday first-round results to annual wage negotiations that far exceeded expectations. The wage hikes were seen as the final data set for the board to consider as part of its deliberations, people familiar with the matter told Bloomberg ahead of that news.

Consensus View

In a survey of 50 economists published by Bloomberg News last week, a slim majority had forecast the BOJ would end the world’s last negative rate in April.

Goldman Sachs Group Inc. is among those expecting the BOJ to raise interest rates for the first time since 2007 at Tuesday’s meeting.

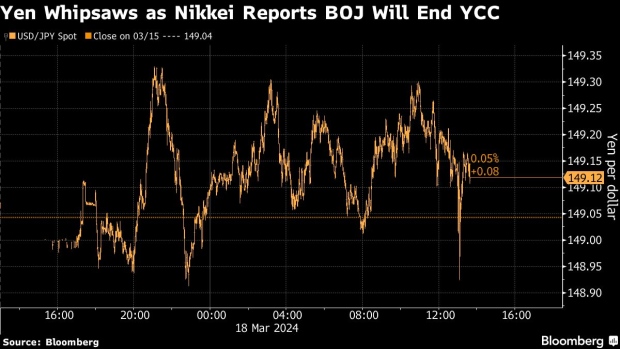

The yen briefly strengthened after the latest Nikkei report, and was little changed at 149.17 per dollar as of 4:44 p.m. in New York. The Japanese currency has been the worst performer against the greenback this year in the Group of 10, down more than 5%.

The central bank has long pursued a goal of achieving sustainable 2% inflation. A key component of that goal is setting in motion a virtuous cycle in which wage growth feeds into demand-led price gains.

--With assistance from Anya Andrianova, Carter Johnson, Malcolm Scott and Toru Fujioka.

(Updates with further details on reported BOJ plans, in fourth paragraph.)

©2024 Bloomberg L.P.