Mar 28, 2024

Brazil’s Central Bank Increases Growth Estimate for 2024

, Bloomberg News

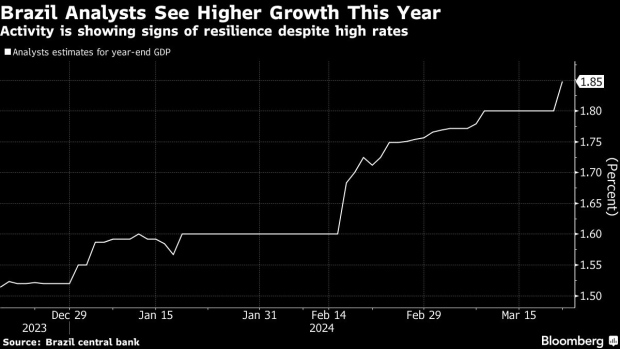

(Bloomberg) -- Brazil’s central bank boosted its 2024 economic growth forecast as higher government spending and monetary easing support household consumption.

The bank expects gross domestic product to expand 1.9% this year, up from December’s estimate of 1.7%, according to its quarterly inflation report published Thursday.

“The moderate revision mostly reflects a slightly stronger-than-expected dynamism of the economy seen in the beginning of the year,” policymakers wrote in the report.

A still strong jobs market and an increase in social spending from Luiz Inacio Lula da Silva’s government has supported disposable income among families, even as Latin America’s largest economy slows from last year’s 3% growth.

The statistics agency said in a separate report on Thursday that the unemployment rate rose as expected to 7.8% in February, with roughly 8.5 million Brazilians out of work. The uptick was largely driven by seasonal factors involving Brazilians returning to the labor force after stopping work at the end of last year.

What Bloomberg Economics Says

“Brazil’s labor market has yet to signal it’s cooling down. Another decline in seasonally adjusted unemployment and advance in labor income will support growth — welcome news for President Luiz Inacio Lula da Silva, who faces declining popularity and needs stronger tax revenues to meet the year’s fiscal target. It’s more concerning for the central bank, which is mindful of wage-price spiral risks to the inflation outlook, especially for labor-intensive services.”

— Adriana Dupita, Brazil & Argentina economist

Click here to read the full report.

Central bankers led by Roberto Campos Neto have reduced interest rates by 3 percentage points to 10.75%, with half-point cuts at every meeting since August. Last week, they signaled another reduction in May, but altered their forward guidance that had previously extended to their next two meetings, citing greater uncertainties.

Read More: Brazil’s Central Bank Discussed Smaller Key Rate Cuts Ahead

Policymakers haven’t given clear signals about the end of the easing cycle, saying they need flexibility to avoid the risk of unfulfilled promises if smaller cuts are needed in the future. Traders interpreted that as leaving the door open to a pause, after a final cut of a quarter-percentage-point in May.

“Giving forward guidance has value when there’s visibility ahead,” Campos Neto told reporters during a news conference following the release of the inflation report. “But not having that visibility anymore doesn’t mean that our path has changed.”

(Updates with central bank comments from a presser in lasts paragraphs)

©2024 Bloomberg L.P.