Mar 29, 2024

Bullish Stocks Narrative Seen as Intact After US Inflation Data

, Bloomberg News

(Bloomberg) -- A cooldown in the Federal Reserve’s preferred gauge of underlying inflation last month, coupled with a rebound in household spending, failed to shift the Wall Street consensus that has lifted stocks to records in the first quarter.

The so-called core personal consumption expenditures price index, which strips out the volatile food and energy components, rose 0.3% from the prior month, slowing from January’s surprisingly strong reading.

The data, released with markets closed for the Good Friday holiday, are in line with the view that while inflation has cooled, it remains stubbornly higher than the Federal Reserve would like, limiting the scope for interest rate cuts this year. At the same time, the numbers are reassuring strategists that the economy continues to hold up just fine after the Fed’s rate-hiking campaign of the past two years.

“Bottom line: I don’t see this doing anything to change either the Fed’s or the market’s narrative right now,” said Steve Sosnick, chief strategist at Interactive Brokers.

Swaps traders on Thursday slightly trimmed wagers that the Fed would cut rates as soon as June, reinforced by the latest Fedspeak. On Wednesday, Fed Governor Christopher Waller said there was no rush to lower interest rates and emphasized that recent economic data warrants delaying or reducing the number of cuts seen this year.

Fed Chair Jerome Powell said Friday’s data is what he was expecting, while acknowledging that the latest reading wasn’t as good as the ones last year.

“It’s good to see something coming in in line with expectations,” Powell said at an event at the San Francisco Fed after the data release. “February is lower but it’s not as low as most of the good readings we got in the second half of last year; but it’s definitely more along the lines of what we want to see.”

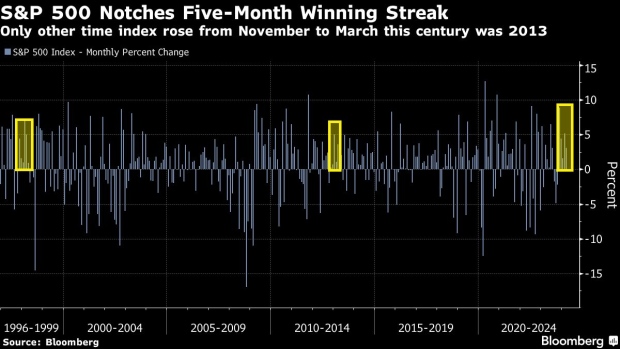

The data comes after a stellar quarter for stocks as investors pile on bets the Fed will be able to achieve a soft landing. Up 10% in the first three months, the benchmark S&P 500 has broken its record 22 times this year, boosting US equity values by $4 trillion. The rapid ascent has led some to worry about the market running too hot. On Friday, two-year yields, more sensitive than longer-maturity debt to Fed policy expectations, rose five basis points to 4.62%.

One concerning part of Friday’s report was the mismatch between spending and income, said Sosnick. While higher spending boosts the economy short-term, it’s unsustainable to spend more and make less. Real personal spending climbed 0.4% last month, above estimates for a 0.1% increase.

US equity and bond futures will open as usual at 6 p.m. New York time Sunday following the holiday.

Here’s what others on Wall Street are saying:

Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors:

It’s a pretty mixed report, so I wouldn’t expect it to meaningfully shift the narrative on inflation or the Fed. The story remains that the steady moderation of inflation has stalled above where the Fed wants it to be, and if growth continues to gain momentum, or even just stays as strong as it’s been, there’s a real risk that inflation heads higher. That would lead us down the path toward no Fed cuts and potentially even a hike.

Marvin Loh, senior macro strategist at State Street Global Markets:

Inflation readings look in line. The Fed had these numbers in mind via CPI and PPI when they met last week. Supercore look to surprise notably to the downside, which will keep a June cut in the cards. Overall, the numbers are not low enough to give the Fed comfort that 2% target will be reached comfortably, but there is a low threshold to start the normalization process this summer.

Chris Low, chief economist at FHN Financial

It underscores the caution Fed Governor Chris Waller and others have expressed recently. They still expect to cut rates this year, but in Waller’s words, there is “no rush,” especially with the strongest real consumer spending since December.

Zachary Hill, head of portfolio management at Horizon Investments:

Data doesn’t change the outlook for monetary policy. But it does reinforce the patient stance that the more hawkish members of the Fed have advanced recently. It further entrenches the notion that the evolution of incoming data, and not economic forecasts, will be the guidepost to interest rates.

Jeffrey Roach, chief economist at LPL Financial:

The trajectory for consumer spending is weakening, especially since real disposable incomes declined in February. Core services inflation is slowing and will likely continue throughout the year. By the time the Fed meets in June, the data should be convincing enough for them to commence its rate normalization process. But where we sit today, markets need to have the same patience the Fed is exhibiting.

Jay Hatfield, chief executive officer at Infrastructure Capital Advisors:

The print might be slightly positive for markets on Monday but PCE can essentially be derived from CPI/PPI. More importantly, French CPI printed this AM at only 0.3% vs expectations of 0.6% with Y/Y rolling down to only 2.3% from 3%. This data validates our view that the ECB will cut rates in June and the Fed will lag with a July cut as PCE continues to print slightly hot over the next few months as the shelter component continues to dramatically overstate rent inflation.

--With assistance from Elena Popina and Rita Nazareth.

(Updates with Fed Chair Jerome Powell’s comment in sixth, seventh paragaphs.)

©2024 Bloomberg L.P.