Mar 29, 2024

Citi Strategists Downgrade US Tech Stocks as Rally to Broaden

, Bloomberg News

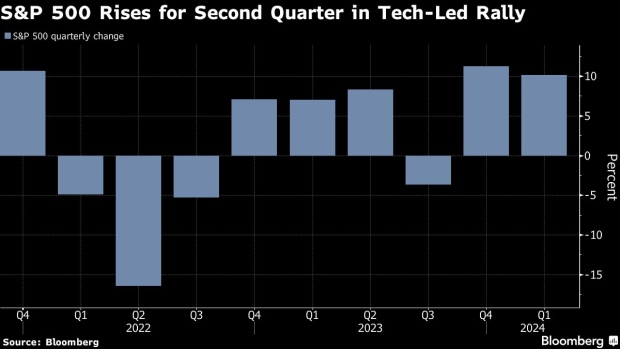

(Bloomberg) -- The US stock rally is set to broaden out beyond technology, according to Citigroup Inc. strategists whose outlook on the sector has turned more cautious.

A team led by Scott Chronert reduced their stance on the tech sector to market-weight from overweight on the back of a new underweight recommendation on hardware companies. They also raised consumer discretionary to overweight.

“The growth-cyclical barbell we have advocated for several months now allows for a broadening into defensive parts of the market, particularly those that are more interest rate sensitive,” Citi strategists wrote.

Within tech, the strategists maintained an overweight on the software sub-sector and are market-weight on semiconductors. Among other sectors, they cut financials to market-weight for the second quarter.

The S&P 500 is already trading 3% above Citigroup’s end-year target of 5,100 “reflecting soft landing and AI enthusiasm.” In a separate note, Chronert pointed out a gauge of investor sentiment from the bank has reached “euphoria,” a level that aligns with lower probability of positive returns over the coming year.

©2024 Bloomberg L.P.