Mar 28, 2024

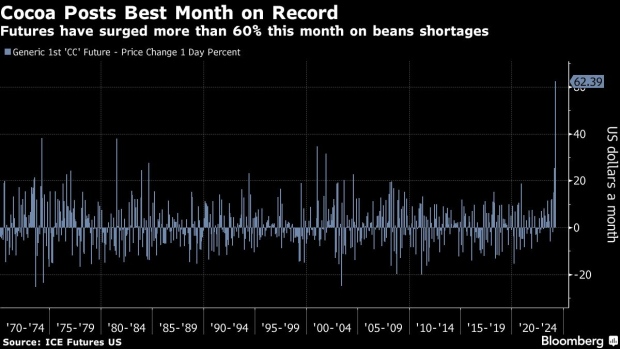

Cocoa Set for Best Month on Record as Bean Shortages Fuel Rally

, Bloomberg News

(Bloomberg) -- Cocoa retreated in New York, but was still on course for its biggest monthly gain on record as chocolate manufacturers rush to secure beans.

Futures are on track to close with a gain of more than 60% this month, after the latest surge pushed prices above $10,000 a metric ton for the first time on Tuesday. Prices have more than doubled this year.

Markets have been choppy since reaching the peak amid profit-taking from traders.

“The trend has been funds liquidating to take prices lower as they take profits. And then industry buying at the lows of the day, jacking prices back up,” said Vladimir Zientek, a trading associate at financial services firm StoneX Group Inc. Cocoa buyers are adding long positions as the desperation for beans continues to grow, Zientek said.

Read More: Cocoa Market Risks Breaking Point as Wild Moves Signal Distress

Futures in New York fell as much as 1.8% to $9,671 a metric ton on Thursday.

Poor harvests on the back of bad weather and crop disease in Ivory Coast and Ghana, where most of the world’s cocoa is grown, and little sign of production relief elsewhere have left the industry in a bind.

Farmers in both countries are also yet to reap the benefits of the current rally, as prices are set by governments ahead of time. That caps their ability to invest in improved farming practices that could boost production, and will keep output curbed in the near future.

The structural issues facing West African producers outweigh any short-term relief that could be induced by good rains in the region as models show higher chances of La Nina, Zientek said.

“I believe the market still has legs. This market has clearly shown us that it has no resistance, it’s plain desperation out on the street,” he added. “I don’t see demand dropping fast enough or hard enough for that to offset the huge drop in supply.”

©2024 Bloomberg L.P.