Jan 5, 2018

Emerging markets pioneer Mark Mobius to retire after 30 years

, Bloomberg News

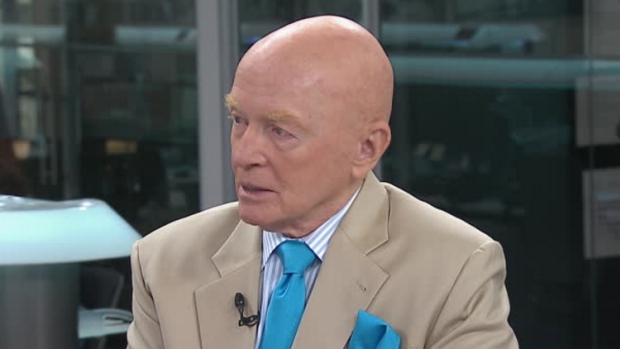

Veteran investor Mark Mobius, the bald-headed market guru who became one of the most recognized authorities on money-making opportunities in Africa, Asia, Eastern Europe and Latin America, plans to retire from Franklin Templeton Investments after three decades with the firm.

The company announced his retirement, effective Jan. 31.

“There is no single individual who is more synonymous with emerging-markets investing than Mark Mobius," Chairman and CEO Greg Johnson said in a statement Friday.

Mobius, 81, who said he kept most of his own money in Templeton funds, made prescient calls on major market movements. He correctly predicted the start of a bull market that began in 2009, snapped up bargains during the Asian financial crisis after Thailand floated its currency in 1997, and bought Russian stocks as panic selling took hold in Russia in 1998. He was also one of the first institutional investors to identify Africa as a promising frontier market, setting up the Templeton Africa Fund in 2012.

“My idea of a bargain is, by the way, not very complicated,” he wrote in “Passport to Profits,” his 1999 book. “I buy stocks in companies with good growth potential over a five-year period.”