Oct 16, 2023

Larry Berman: Why a 'core and explore' portfolio makes sense

By Larry Berman

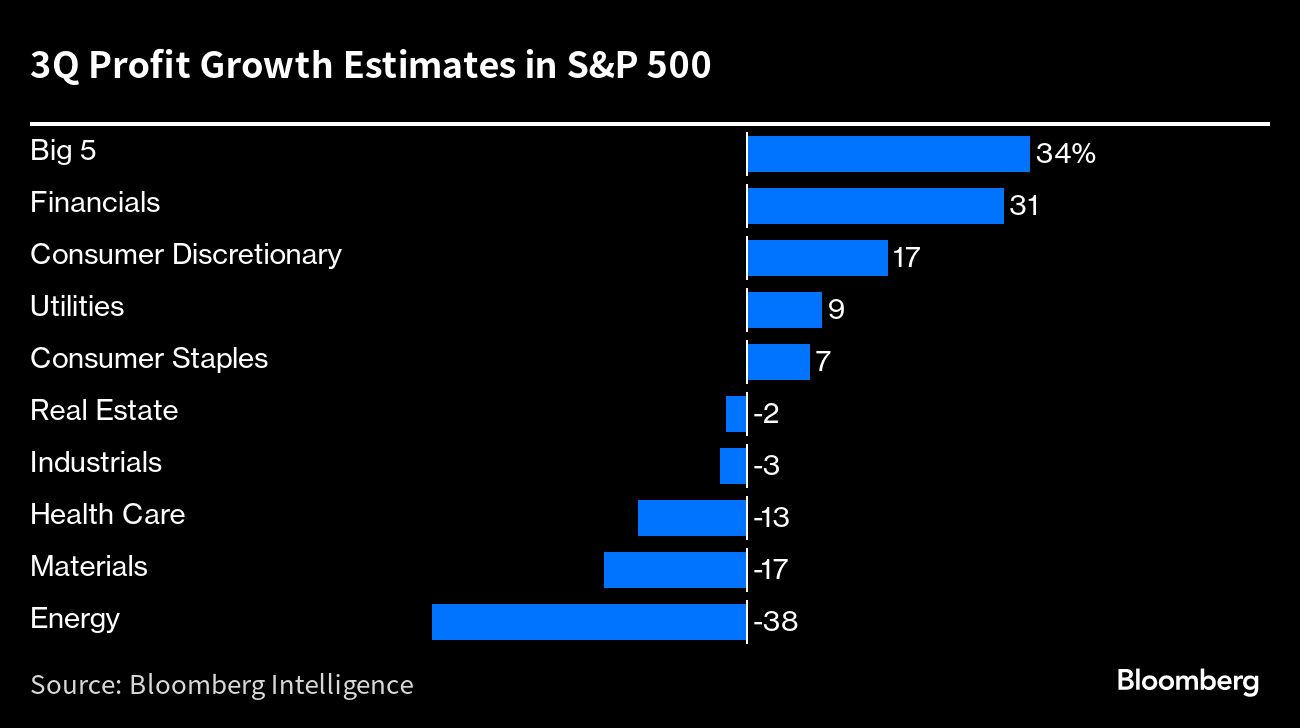

The largest five stocks are driving most of the profit growth for the S&P 5 (not a typo) this year. The remainder of the S&P 500 is showing EPS declines on average, with energy being the biggest drag. This should not be a surprise to investors.

Building a long-term portfolio that will be resilient in most markets is not just about dividends or yields, but it needs to include multiple assets classes and increasingly alternative types of returns. We can look to what Canada Pension Plan Investment Board (CPPIB) is increasingly doing for a guideline of what you should consider. For example, DIY dividend-focused investors tend to have a concentration in Canada (for CRA tax benefits), dividends and speculative stocks (think SPACs, mining and marijuana to name just a few) and have much less in growth areas like technology and consumers. Canada has very little of either, and a lot more speculative companies, which compounds the challenge for stable returns.

Many investors should consider structuring their portfolios to capture core market cap exposure while exploring for what they need to meet their longer-term needs and goals. This way, a significant portion of an investor’s portfolio will always track market returns. Core holdings include main indexes like the S&P 500, S&P TSX, MSCI EAFE (international developed markets x-U.S.), MSCI Emerging Markets. There are a few ways to get this low-cost exposure with one ETF (ZEQT, VEQT, XEQT) in Canada.

If you are a taxable investor (non-registered), you might want to get that core exposure with Horizon’s total return ETFs. For yield-based investors, covered call strategies offer some tax efficiencies from foreign exposures too.

If you are a taxable investor (non-registered), you might want to get that core exposure with Horizon’s total return ETFs. For yield-based investors, covered call strategies offer some tax efficiencies from foreign exposures too.

By creating a “core and explore “portfolio that suits your personal needs, it won’t matter that dividend stocks globally are down this year as we see in CYH (iShares Global Monthly Dividend). You won’t need to care if only five stocks are doing all the lifting to markets and your portfolio is loaded up on dividend payers having a bad year. CPPIB builds their portfolio for all Canadians to be resilient and targets a seven per cent or more return in the long run with lower risk. Perhaps you should too!

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman

www.etfcm.com