Mar 28, 2024

Marc Andreessen, Galaxy Digital Back $75 Million Crypto VC Fund

, Bloomberg News

(Bloomberg) -- Venture capitalist Marc Andreessen, Accolade Partners and Galaxy Digital are among investors in crypto VC firm 1kx’s latest fund, as digital asset funding stages a tentative comeback from a two-year slump.

Chris Dixon, a partner at Andreessen Horowitz, is also among limited partners in the fund, for which 1kx raised $75 million, 1kx founding partner Lasse Clausen said in an interview. Accolade is the anchor investor in the new vehicle, according to Clausen.

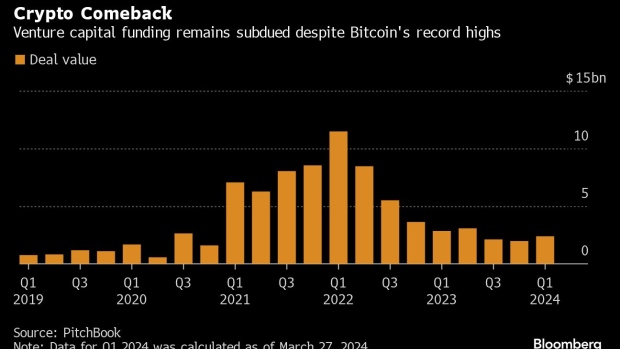

Cryptocurrencies have soared this year, buoyed by the approval of US exchange-traded funds tied to directly to Bitcoin in January and expectations of lower interest rates. But the broad price gains that started in early 2023 have been slower to spill into VC funding, leaving valuations attractive according to Clausen.

Read More: Crypto Venture Capital Backers Are Dubious of Bull-Market Hype

“The VC investment market of crypto always lags [token] prices,” he said. “A lot of VCs aren’t back yet, and the valuations are still very reasonable and lowered, especially for these early-stage rounds.”

Spokespeople for Andreessen, Dixon, Galaxy and Accolade Partners confirmed their investments.

Clausen founded 1kx together with Christopher Heymann in 2018. Its portfolio includes investments in Paris-based crypto staking firm Kiln, nonfungible token collection Pudgy Penguins, digital-asset marketplace Rarible and metaverse platform The Sandbox. The firm has raised about $200 million for its existing open-ended fund since early 2022, Clausen said.

1kx is focusing on areas including crypto applications targeted at consumers, Clausen said. The new fund has already made about five investments, he added without naming the startups it backed.

©2024 Bloomberg L.P.