Mar 28, 2024

Money Managers Hire Investigators to Find Private Asset Values

, Bloomberg News

(Bloomberg) -- Investor faith in private market asset values has plumbed such depths that some are taking matters into their own hands.

More money managers are hiring investigators for on-the-ground information to help them learn more about the firms they’re lending to or invested in, as well as value underlying collateral, according to Jason Wright, senior managing director at financial crimes, risk, and regulatory advisory firm K2 Integrity, the corporate investigative firm co-founded by Jules and Jeremy Kroll.

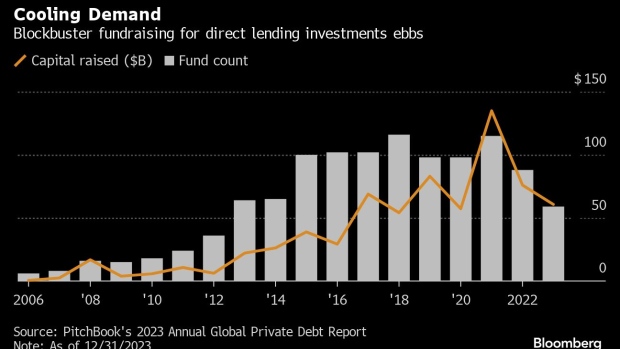

Private credit has boomed into one of Wall Street’s fastest growing industries, more than tripling in size in the last decade to $1.7 trillion as money managers gravitated to investments that promised high returns as well as a shield from mark-to-market losses. Historically celebrated for providing stability even when public securities were whipsawing, that attribute is increasingly being seen as a liability as investors fret that untroubled values may not be accurately reflecting true risks.

“There’s a lot of discretion used by the managers of these portfolios and the biggest questions we’re fielding now are about recoveries in these assets more broadly, and how much can be recovered,” Wright said in an interview. “What’s the true value of the debt here?”

In February, Bloomberg News reported that in some cases the exact same loans were being marked wildly differently depending on whose portfolio they were in. The huge variations in pricing is also spooking regulators who are concerned that a lack of consensus may be masking more distress under the surface.

Read more: Private Credit’s Code of Silence Is Hiding Market’s Flaws

A growing trend within private markets has been the rise of so-called business development companies, which are essentially closed-end funds that invest in small- and medium-sized private companies, and are often publicly traded. Demand for non-traded private BDCs as well as other private and semi-liquid vehicles, where money changes hands at the marks the managers have decided, has also sky-rocketed in recent years.

Business development companies own approximately 40% of all deployed private credit in North America, according to a January research paper published by Barclays. That represents assets under management of around $315 billion, according to Corry Short, a Barclays strategist, who co-authored the report.

“Interest in private markets more broadly, and how business development companies mark their assets have been a key interest of clients lately,” Wright said. “Now we have large funds asking, have these valuations within private markets and credit portfolios been tested, and how can we test them?”

BDCs also invest in distressed companies. They are open to retail investors and are becoming ever-more popular among pensions, insurers and family offices, as well as other international institutions.

To be sure, increasing numbers of lenders pay third-party valuation specialists to look at their marks, and funds are routinely audited.

However, recent fundraising data shows that some of the edge has been taken off the dizzying rise in private credit, spurring some BDCs to start cutting fees to help keep capital coming in.

Some investors are going a step further and betting directly against BDCs to capitalize on any future losses.

There was $439 million of new short selling activity year-on-year against the funds, an increase of 37%, according to data from S3 Partners, a financial analytics firm. Overall BDC short interest is $1.32 billion, representing 3.85% of the short interest float.

“In some extreme cases, we’re seeing cases of lending terms being too good to be true,” Wright said. “When investigated, it turns out that the collateral being promised to investors for lending has in fact been pledged to others. Sometimes multiple times over.”

Deals

- Crypto miner Bitdeer Technologies Group is in talks with private credit firms to arrange about $100 million in financing

- Stone Point Capital Markets led a $475 million delayed draw term loan for its own portfolio company, Fort Worth, Texas-based Higginbotham Insurance Agency

- Stone Point Capital Markets led a senior secured financing to support Safe-Guard Products comprised of a $1.235 billion term loan and a $75 million revolver

- Private credit managers are doing significantly more fossil-fuel deals now than just a few years ago, as they step into a void left by banks exiting assets they worry pose too big a climate risk

- Blackstone Inc.-backed Encore Group USA is looking to raise at least $500 million of preferred equity as it works with Goldman Sachs Group Inc. to deal with loans that are set to come due in the next two years

- Blackstone and KKR participated in the more than $500 million private-financing deal with engineering firm STV Group

- Centerview Partners has held conversations with private credit lenders to refinance the outstanding debt of wheel supplier Superior Industries International Inc.

- Banks and direct lenders are vying to arrange a debt package for about €1.8 billion to back the potential buyout of Apleona Group GmbH

- Cerberus-backed Electrical Components International has held discussions with private credit firms for a new loan that would refinance the company’s broadly syndicated debt

- Ares Management Corp. and Leonard Green & Partners-owned Press Ganey is in talks for an investment of about $1 billion of preferred equity to take out more-expensive junior debt

Fundraising

- Pemberton Asset Management said it has closed its third-generation strategic credit fund with €2.3 billion of firepower, bringing total assets under management for its three strategic funds to €4.9 billion

Job Moves

- Carlyle Group Inc.’s Jason Ridloff, a managing director within the firm’s global credit arm, has left

- Private credit lenders are facing increased scrutiny of their staff retention plans following the exodus of more than 20 employees from Barings this month

- Warburg Pincus hired Goldman Sachs Group Inc. veteran Lee Becker as a managing director within its capital solutions group

- Muzinich & Co Inc. is expanding its private credit business in Australia to capture a slice of the country’s A$3.6 trillion pension pool even amid a slowdown in global fund raising activity

Did You Miss?

- BoE Probes High Rates Risk on Indebted Private Equity Companies

- Private Credit Both Friend and Foe to Banks, RBC’s US Chair Says

- Ares, KKR Among Lenders Seeking to Capitalize on Barings Fallout

- Ares’ Row With Indonesia Debtors Over $200 Million Loan Delayed

--With assistance from John Sage and Kat Hidalgo.

©2024 Bloomberg L.P.