Sep 7, 2016

Oil patch sentiment worse than National Energy Program: Ex-Encana CEO

, BNN Bloomberg

If Canada can’t clean up its own regulatory framework for the energy sector, companies will continue to expand south of the border, according to the founding CEO of Encana (ECA.TO).

Gwyn Morgan joined BNN on Wednesday to discuss the rationale and the implications of Enbridge’s (ENB.TO) $37-billion all-stock takeover of Spectra Energy (SE.N).

He said the deal is symptomatic of the rampant opposition to pipeline development in Canada.

“It’s an inevitable trend, really,” Morgan said. “If you can’t get the product out… if your customers – IE, the producers of oil and gas - can’t get their product to market, and you can’t do the job for them by expanding because of all the major issues we have with getting anything done in this country in terms of the energy business; then, naturally, you’re going to go somewhere where there is growth, where there is market access and where the regulatory regime is more efficient.”

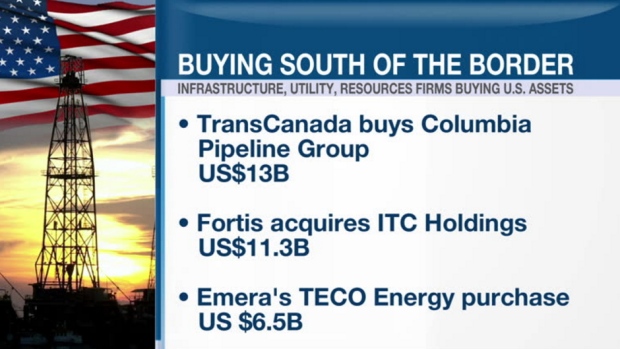

The Enbridge takeover announced Tuesday was the latest in a wave of deals that have seen Canadian companies expand in the U.S.

TransCanada (TRP.TO) completed its $13-billion purchase of Columbia Pipeline Group on July 1, Fortis’s (FTS.TO) acquisition of ITC Holdings for US$11.3 billion was approved by shareholders in June, and Emera (EMA.TO) closed its US$6.5-billion purchase of TECO Energy in early July. Enbridge also bought a minority stake in the Bakken Pipeline System in early August.

Morgan sees a dramatic shift in the current environment compared to during his years with Encana and even his earlier days with the Alberta Energy Company, beginning in the mid-1970s. However, he called the current climate for producers “worse than any downturn that’s ever happened in the industry, even the National Energy Program” of the early 1980s.

“If you look at the oil situation in Canada, four million barrels a day, we’re losing plus-or-minus $10 a barrel; that’s $40 million a day of revenue that is coming in at less than the world price,” he said.

“Until we can get rid of that Canadian price discount in both oil and gas… then we’re going to have low cash flow and that’s devastating to companies in terms of their overall financial situations, but it’s also devastating to investment.”

Morgan’s solution to the sector’s current woes is to continue operating in the expectation that Canada will have an energy-based economy and to invest in ways to get Canadian resources to a larger market.

“The energy is going to be produced somewhere. It’s a fallacy [to think] that it’s not going to be produced somewhere -- because it’s needed,” he said. “All of the world projections show that oil and gas demand is going up and not down. And we can’t do much about that except shoot ourselves in the foot and not be a part of it.”

“We need to do what everybody knows we need to do and that is build some pipelines.”