Mar 28, 2024

US Corporate Borrowing Spree Clocks Busiest First Quarter Ever

, Bloomberg News

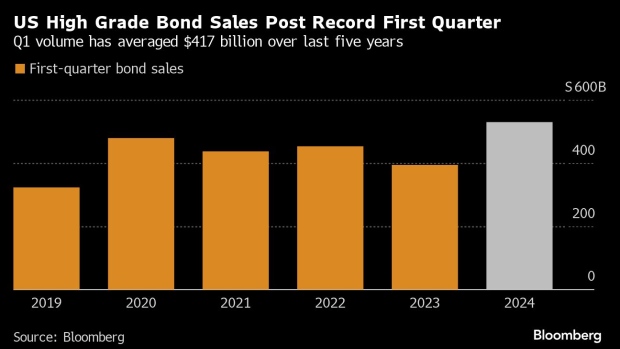

(Bloomberg) -- The primary US investment-grade corporate bond market logged its busiest first quarter on record, super-charged by investors clamoring for high yields before the Federal Reserve starts cutting interest rates.

Blue-chip firms have capitalized on robust investor demand to borrow a record $529.5 billion this year through Wednesday, far outpacing the previous high of $479 billion in the first three months of 2020, according to Bloomberg News analysis. Sales hit a record in January and February and March issuance of $142.2 billion has exceeded expectations.

“Spreads have been extremely resilient, and actually rallied in the quarter as demand has overwhelmed this record pace,” said Matt Brill, head of North America investment-grade credit at Invesco Ltd.

Read more: US Corporate Bond Spreads Rally to Lowest Level Since 2021

Multi-billion dollar bond offerings to fund mergers and acquisitions helped fuel the borrowing binge, a trend that Bloomberg Intelligence analyst Robert Schiffman expects will boost debt sales through the rest of 2024. Borrowing costs that are still attractive for issuers and a rising maturity wall will also contribute to more sales, he wrote in a note Wednesday.

Home Depot Inc. told investors on Thursday it expects to take on $12.5 billion of debt to help fund its planned purchase of building-products distributor SRS Distribution Inc.

“High quality debt issuance is back in vogue,” wrote Schiffman.

The record pace of issuance is likely unsustainable going forward. Early issuance projections for April from Wall Street syndicate desks are teetering around $100 billion, compared to about $65 billion sold in the same month last year. Still, that’s way below the pandemic-fueled borrowing craze when the market notched $285 billion in April 2020.

©2024 Bloomberg L.P.