Mar 18, 2024

Wall Street Banks Tap Europe’s Buoyant Bond Market

, Bloomberg News

(Bloomberg) -- Morgan Stanley and JPMorgan Chase & Co. are piling into Europe’s bond market to raise money, the first Wall Street banks to do so this year as they take advantage of strong funding conditions.

Morgan Stanley’s three-part €5 billion ($5.5 billion) offering is its biggest since at least 2008, while JPMorgan has already drawn more than €6.2 billion in orders for its €2 billion sale on Monday, according to people familiar with the matter. The former last raised publicly-syndicated euro debt more than a year ago, and three tranches is its most ever.

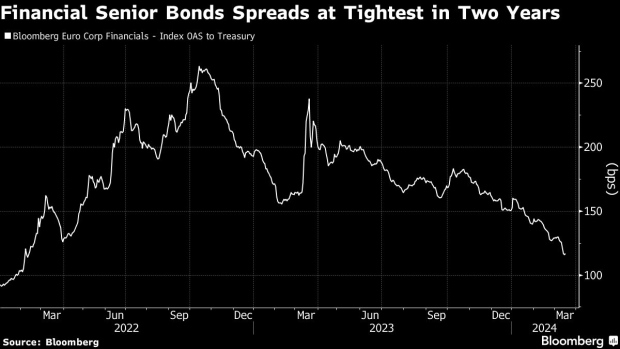

The US banking giants are tapping the market at an opportune time for new debt. Credit markets have continued to rally this year as cash flows into the sector, sending borrowing costs versus government bonds to among the lowest in two years.

“When asked the question ‘What could go wrong?’ the mind draws a blank,” said Rabobank strategists led by Matt Cairns in a note, pointing to the various shifts the market has “shrugged off” such as tempered expectations for rate cuts this year, fears of a debt crisis in commercial real estate and disrupted global shipping lanes. “Investors keep snapping up whatever comes their way.”

Read more: Bond Rush Is Breaking Down a Maturity Wall That Everyone Feared

While Wall Street is only just coming to issue in Europe, the pace of the region’s bond sales and demand overall have already smashed records this year.

©2024 Bloomberg L.P.