Mar 18, 2019

Millennials 'buried' in student debt as insolvencies surge: Study

, BNN Bloomberg

A lot of millennials are already going broke.

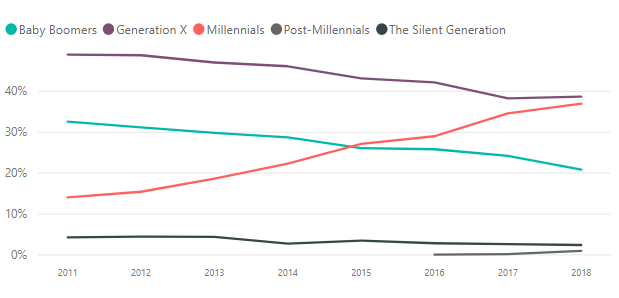

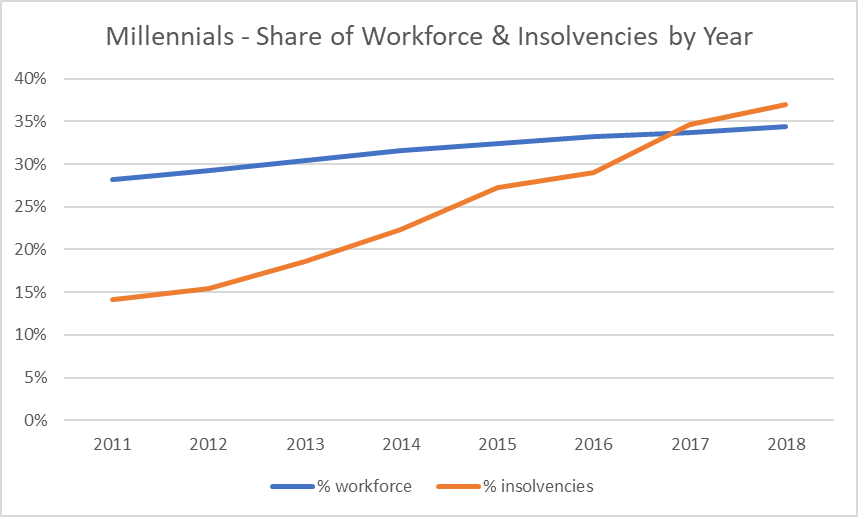

According to a study released Monday by Hoyes, Michalos & Associates Inc., almost two in five insolvency filings in Ontario now come from the millennial generation, defined in the report as those born between 1981 and 1996.

The key catalyst for the debt burden placed on millennials, the report finds, is student loans.

“Millennials are a generation buried in student loans which is why we are seeing such a dramatic rise in student debt driven insolvencies,” the report notes. “In our 2018 study, almost one in five (18 per cent) insolvencies involved student debt with 64 per cent of student debt insolvencies filed by millennials, followed by Generation X at 31 per cent.”

The average amount owed by those affected by student debt was $14,311 in 2018.

Making matters worse, among those millennials running a tab on plastic, the average amount of credit card debt last year was a whopping $11,716.

The report, which is based on 4,200 personal insolvency filings in Ontario last year, states that much of that credit card debt is racked up through everyday use, as opposed to big-ticket purchases.

“Millennials don’t limit their credit card use to big-ticket items,” the report states. “They are highly likely to pay for everyday goods and services, including entertainment, groceries, and clothes, as well as make online purchases with credit cards, which can lead to financial problems when credit is used to balance their budget, with minimum payments viewed as just another monthly expense to be covered.”

“After the Silent Generation (those 73 years old and older in 2018), Millennials are the most likely of any cohort to blame financial mismanagement as a primary cause of their insolvency, including the overuse of credit.”

The dwindling number of millennial homeowners leaves fewer and fewer of the indebted with an easy escape plan, the report added.

“Just under three per cent of all millennial debtors owned a home at the time of filing,” the report found. “Having been largely locked out of homeownership, they are unable to refinance their debt at lower rates through any rising equity in their home.”