Feb 21, 2024

Nvidia's high-stakes earnings moment has entire market on edge

, Bloomberg News

What to expect ahead of Nvidia's Q4 release

Nvidia Corp.’s market-leading advance has left even the bulls questioning if an earnings beat will be enough to propel the AI chipmaker’s shares higher.

The key now, for Nvidia and the entire market, is whether the company can meet revenue estimates and assure investors that it sees further growth in generative artificial intelligence. Goldman Sachs Group Inc.’s trading desk has called it “the most important stock on planet earth,” given its outsize influence on equity gains this year.

“Nvidia has been the driver, the one stock that really set the tone,” said Kim Forrest, chief investment officer of Bokeh Capital Partners LLC. “That’s why everybody is fascinated by this thing and if it can put up another bunch of numbers that are impressive.”

Nvidia shares slipped as much as 4.1 per cent Wednesday, its fourth consecutive day of declines. Intel Corp. Chief Executive Officer Pat Gelsinger announced that the company has a US$15 billion foundry pipeline midday in New York. Shares of Intel were also down as much as 2.5 per cent in intraday trading Wednesday.

Even with this week’s declines, Nvidia boasts a market capitalization of about $1.7 trillion. It has the third-highest weighting in the S&P 500, behind only Microsoft Corp. and Apple Inc., so a swing either way will add or erase billions of dollars in value for investors.

The stock is up about 35 per cent in 2024, even with this week’s slip. That’s the biggest gain on the S&P 500 Index to start the year, and it builds on last year’s 239 per cent surge, also topping the benchmark gauge. Nvidia has added more than $400 billion in market value just this year.

Wall Street expects another banner quarter, with more than $20 billion in revenue, a jump of nearly 240 per cent from a year earlier and the third straight period of triple-digit-percent gains, data compiled by Bloomberg show. Nvidia reports earnings after Wednesday’s close.

The market’s immediate response to Nvidia’s last two earnings announcements doesn’t inspire optimism. Shares fell after its November release, which failed to meet lofty expectations. And in August, a market rout erased nearly all of a rally from a blowout report. But in both cases, the shares eventually powered higher.

“The stock always looks the most expensive right before they open their mouths,” said Michael Sansoterra, chief investment officer at Silvant Capital Management, who sees further upward momentum given Nvidia’s leadership in AI. “It’s hard to say if you’re going to get paid on earnings day, but I don’t think that drastically matters.”

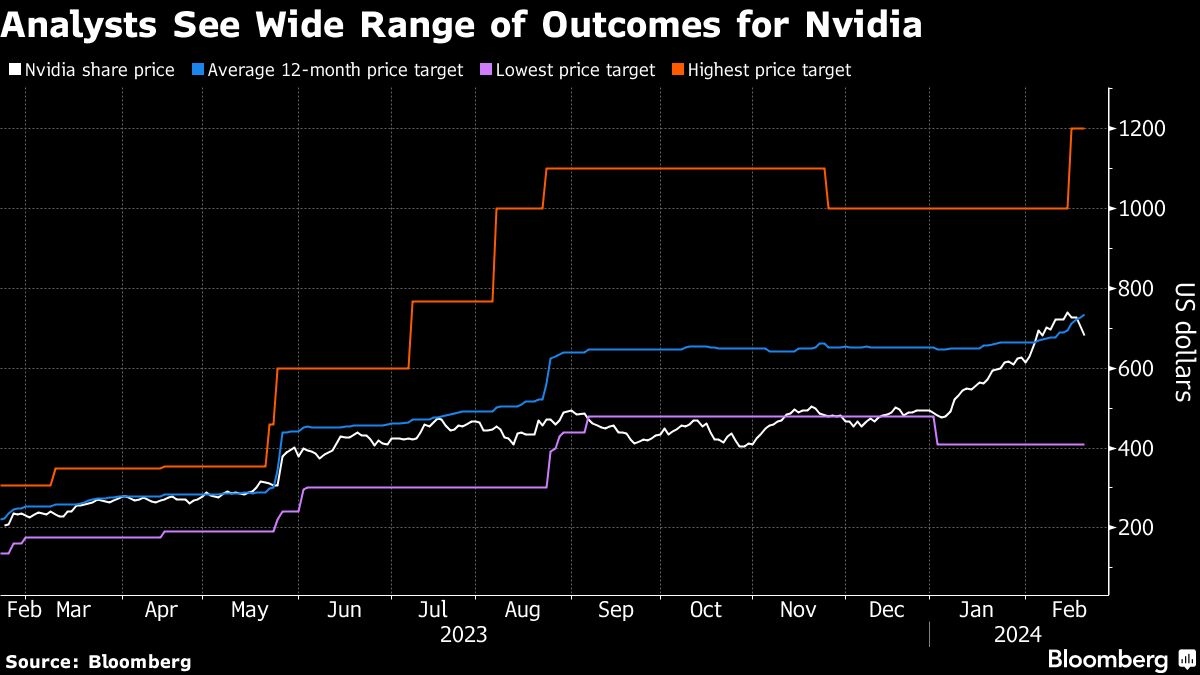

Wall Street is overwhelmingly bullish on the shares. The stock has 60 buy ratings, five holds and one sell, among analysts tracked by Bloomberg. The average 12-month price target of about $734 implies a roughly eight per cent gain.

At Piper Sandler, analysts led by Harsh Kumar expect a modest beat for revenue and earnings per share, and solid forward guidance for data-center revenue. But that still may not be enough to lift the shares, they said in a note last week.

On such a result, “we feel the stock would remain flattish given the recent run up over the prior two months paired with the extremely high expectations going into the print,” Kumar wrote in the note, in which they boosted their price target to $850 from $620.

A post-earnings pullback wouldn’t be a surprise, said Bank of America Corp. analysts, even though they say the company’s performance supports the strength to start the year.

“One interpretation of this Nvidia move is a mix of fear and greed and indiscriminate investor chase for all things AI,” BofA’s Vivek Arya wrote in a note last week reiterating that Nvidia is a top pick heading into earnings. “We acknowledge those factors, but believe it understates the company‘s solid execution and EPS revisions.”

There’s also a camp of investors that’s ready to pounce on the shares should they falter after Wednesday’s announcement.

“Any sort of pullbacks are going to viewed as these limited windows where investors who are going to want to invest in AI for three-to-five years get a chance to buy it,” said Gene Munster, managing partner of Deepwater Asset management.

Forward expectations for the company are so lofty that its valuation still looks relatively inexpensive. Nvidia trades at roughly 32 times forward earnings, compared with about 25 for the Nasdaq 100.

“For a stock that’s up over 200 per cent in the past year, it’s surprisingly still attractively priced,” Munster said.