Feb 26, 2024

Trans Mountain pipeline seen driving Canadian oil to three-year high

, Bloomberg News

Oil rises as Red Sea attacks on ships cause disruptions

Canada’s relatively cheap heavy crude is set to spike temporarily in the coming months as a massive new export pipeline starts operations just as oil-sands companies curtail production.

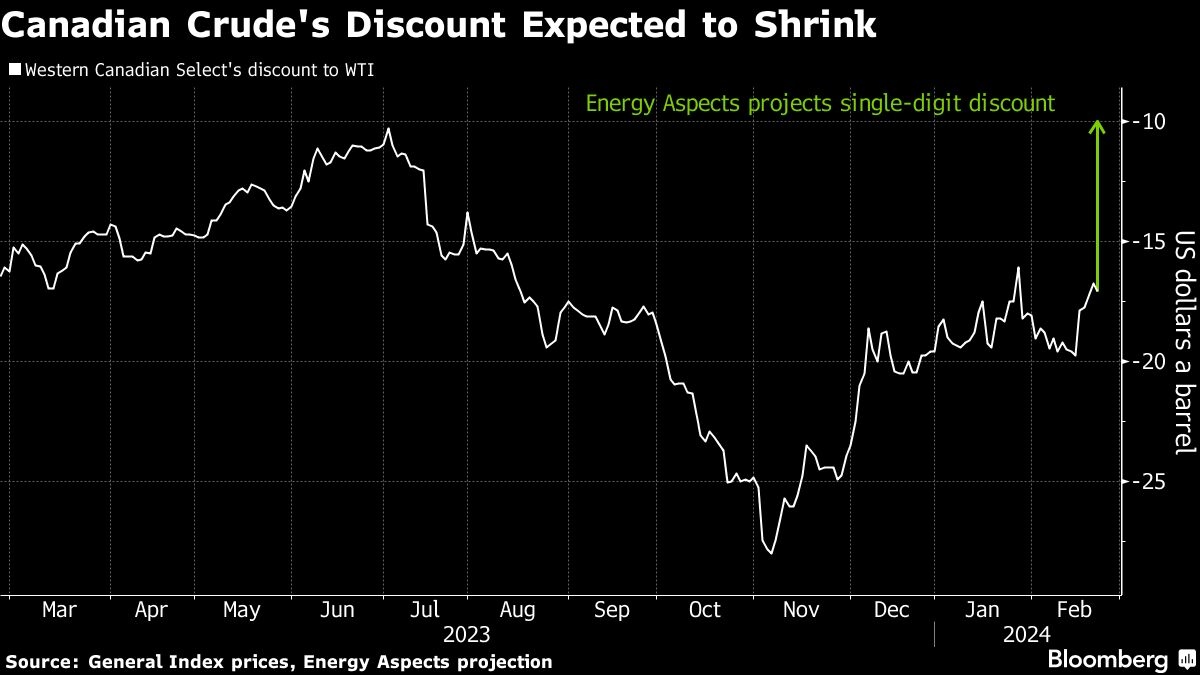

Western Canadian Select’s discount to U.S. benchmark West Texas Intermediate may shrink from its current level of about US$17.10 per barrel to less than $10 a barrel between May and July, according to Jeremy Irwin, senior oil markets analyst at Energy Aspects. The last time the discount was in single digits was in April 2021.

The pricier crude would raise costs for refiners in the U.S. Midwest who rely heavily on Canadian oil and have long benefited from the discounts it has sold at, partly because of a lack of pipelines. Those swelling costs may be partly passed onto U.S. Midwestern drivers as higher gasoline prices.

Driving the potential gain for Canadian crude is the expansion of the Trans Mountain pipeline, which will add the capacity to ship an additional 590,000 barrels of oil a day from Alberta to a Pacific Coast port and reduce producers’ reliance on American refiners. At the same time as the pipeline is due to start up in the second quarter, major oil-sands companies including Imperial Oil Ltd., Canadian Natural Resources Ltd. and Suncor Energy Inc. are planning to reduce output as they perform maintenance work on their facilities.

Longer term, the discount on Canadian crude may return to normal levels or even widen. S&P Global estimates that Alberta oil producers are poised to add 500,000 barrels a day of supply by the end of next year, which will take up almost all of the new capacity on Trans Mountain. Filling up the line leaves the province’s drillers at risk of the pipeline shortages that have bedeviled them for years

Energy Aspects had warned of the potential overlap of oil-sands maintenance and Trans Mountain’s startup in a November report. Over the long term after the Trans Mountain startup, Canadian crude’s discount may average about $12 a barrel, Irwin said.

Canada sent 3.14 million barrels of oil to the U.S. Midwest in November, accounting for almost half of the U.S.’s crude imports, according to the Energy Information Administration.